To get the Asia AM Digest every day, SIGN UP HERE

The anti-risk Japanese Yen and Swiss Franc became benefactors of aggressive risk aversion as Wall Street suffered losses that were last seen in 2011. Likewise, the sentiment-sensitive Australian and New Zealand Dollars declined. Today’s moves echoed Friday’s performance when strong US labor data boosted inflation expectations.

A singular catalyst for the selloff was not readily apparent. The move began after upbeat service-sector ISM survey data crossed the wires, but with some delay, warning against linking the release and the subsequent meltdown in risk appetite.

Speculators and traders alike also bought into US Treasuries as the focus turned from making profits to seeking shelter. Indeed, US government bonds such as the 2-year, 5-year and 10-year saw yields decline and prices rise. This in turn helped boost the US Dollar as well.

Fear in the markets might continue to spread, Nikkei 225 futures are pointing lower ahead of Tuesday’s open. In addition, the RBA’s first interest rate announcement of 2018 will see traders looking for any signs that the central bank could raise rates by the end of the year.

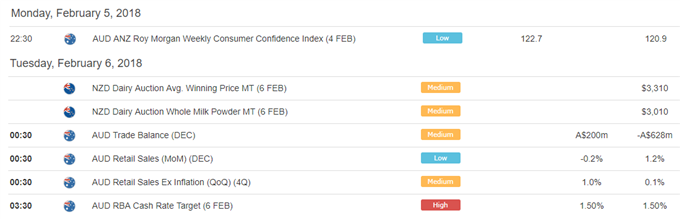

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

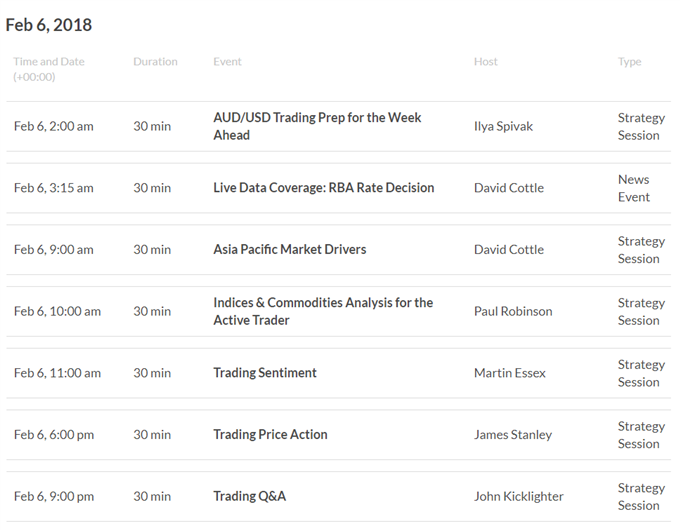

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

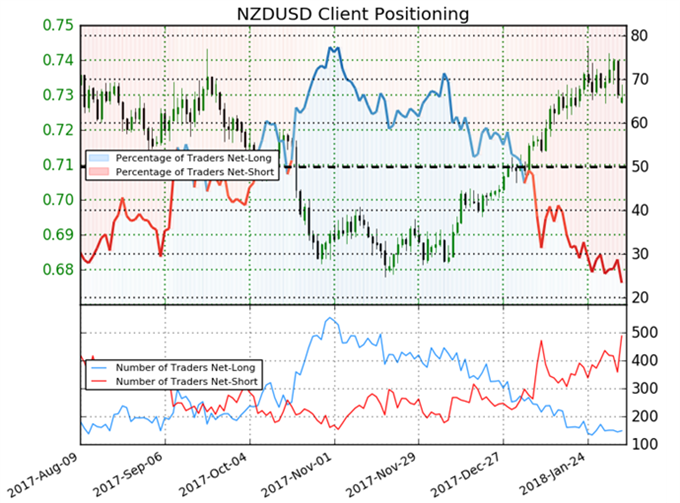

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 23.4% of NZD/USD traders are net-long with the ratio of traders short to long at 3.28 to 1. In fact, traders have remained net-short since Jan 05 when NZD/USD traded near 0.70859; price has moved 2.9% higher since then. The number of traders net-long is 6.4% higher than yesterday and 6.9% lower from last week, while the number of traders net-short is 34.8% higher than yesterday and 21.1% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bullish contrarian trading bias.

Five Things Traders are Reading:

- Dow, SPX Suffer Worst Single Day Loss Since 2011 - A Full Turn? by John Kicklighter, Chief Currency Strategist

- Dollar Unfazed by Highest Non-Manufacturing Reading Since 2005 by DailyFX Research

- Cryptocurrency Price Crash Continues, Lower Highs Dominate by Nick Cawley, Analyst

- AUD/USD Risks Further Losses with RBA Expected to Stay on Hold by David Song, Currency Analyst

- Australian Dollar Can’t Hope For Much From RBA Policy Call by David Cottle, Analyst

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here