To get the Asia AM Digest every day, SIGN UP HERE

The US Dollar faced renewed selling pressure Friday in a move that appeared corrective following Thursday’s surge. That was inspired by comments from President Trump, who contradicted Treasury Secretary Mnuchin to signal that his administration favors a strong domestic currency. The greenback unwound all of the gains inspired by Mr Trump’s remarks, tellingly ignoring fourth-quarter US GDP data.

The Australian Dollar traded broadly higher as local bond yields rose, hinting that a hawkish shift in RBA monetary policy expectations drove the currency’s advance. A singular catalyst for the move is not readily apparent. Priced-in rate hike bets implied in OIS positioning suggests Governor Philip Lowe and company will issue one 25bps increase sometime between August and the end of the year.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

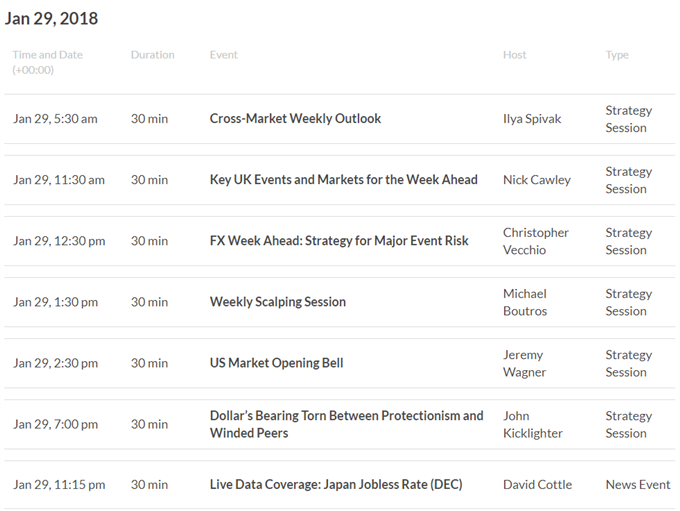

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

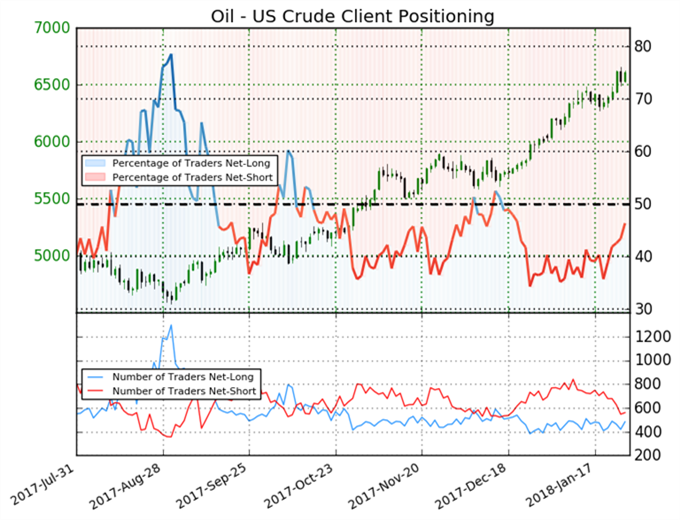

IG Client Sentiment Index Chart of the Day: Crude Oil Price

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 46.3% of traders are net-long crude oil, with the ratio of traders short to long at 1.16 to 1. The number of traders net-long is 8.4% lower than yesterday and 15.6% higher from last week, while the number of traders net-short is 11.7% lower than yesterday and 28.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests crude oil prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current crude oil price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading:

- Weekly Trading Forecast: Can FOMC, Jobs Data Lift the US Dollar? by DailyFX Research Team

- Dollar and Equities to Focus on US Protectionism over Fed Policy Next Week by John Kicklighter, Chief Currency Strategist

- Traders Urged to Respond to Proposed European Rule Changes by Martin Essex, MSTA, Analyst & Editor

- EUR/USD Weekly Technical Outlook: Is the Euro ’There’ Yet? by Paul Robinson, Market Analyst

- Bitcoin Elliott Wave Forecasts Dominant Bearish Trends by Jeremy Wagner, CEWA-M, Head FX Trading Instructor

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here