Talking Points:

- The Bank of Canada raised the overnight lending rate by 25-bps to 1.25%, as was widely expected (rates markets were pricing in a 90% chance ahead of time).

- A cautionary outlook on growth, inflation, and wages led the BOC to tamping down expectations of a more aggressive path of easing.

- See the DailyFX Economic Calendar for upcoming economic data and for a schedule of live coverage see the DailyFX Webinar Calendar.

See our longer-term forecasts for the US Dollar, Euro, British Pound and more with the DailyFX Trading Guides

Today marks the third time that the Bank of Canada has raised the overnight since July 2017, now at 1.25%. Going into the decision, the implied probability of a 25-bps rate hike reached 90%, according to overnight index swaps. The decision, which was only priced in at 35% after the December BOC meetings, comes after back-to-back stronger than expected jobs reports and inflation readings for November and December.

On Inflation

The BOC noted that, “CPI inflation is estimated to have averaged 1.8% fourth quarter of 2017.” This is attributable to “temporary factors,” which include past electricity rebates, below-average food price inflation, and exchange rate pass-throughs.

Going forward the expectation is that inflation is will continue to be near2%. The BOC expects “temporary” factors to dissipate over time. The BoC further stated, “inflation will likely ease in January 2018, reflectingthe transitory effects of elevated gasoline prices a year earlier. Inflationis then expected to rise as the temporary effects of past fluctuations in consumerenergy and food prices fade.”

Wages Pressures to Persist

The BOC recognized that underlying wage pressures remained modest despite wage growth.The central noted that, “the rapid pace of hiring and swift decline in the unemploymentrate in the past few months indicate that labour market slackis being absorbed more quickly than expected.”Although“several other factorsare expected to constrain wage gains.” This includes an elevated long-term unemployment rate lowyouth participation rate. The Bank believes that Global competition—automation and outsourcing—is also weighing on wages.

Forward Guidance, Economic Outlook

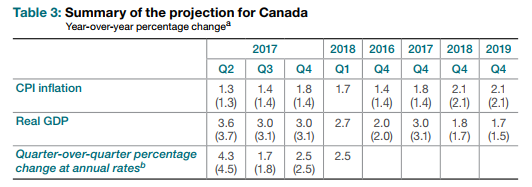

The BOC believes that the Canadian economy will grow “above potential,” at an average of 2.5% over the fourth quarter of 2017 and the first quarter of 2018. Subsequently, quarterly growth is expected to “moderate andaverage.”See the summary projections below:

The Bank also briefly commented on the flattening Canadian yield curve, “the rising short-term rates combined with comparatively stablelong-term yields have resulted in a flatter Canadian yield curve, in line withdevelopments in global markets.” Interestingly, elevated levels of household debt are likely to amplify higher interest rates on consumption. These higher debt services costs will put pressure on borrowers, forcing a moderation in consumption.

The inflation outlook may deteriorate if Canadian exports weaken, this is as a direct result of less than favorable NAFTA outcome. Also, as previously mentioned, higher household debt could exacerbate spending.

Market expectations are currently predicting two more hikes for this year; one in April and another by July.

Price Chart 1: USD/CAD 30-minute Chart (January 11 to 17, 2018)

Today’s Monetary Report provided little forward guidance on the BoC’s next hike. This was reflected in the Canadian Dollar. Following the release of the Monetary Policy Report the Canadian Dollar fell sharply against the US Dollar. USDCAD hit its highest level since January 12. At the time this was written, USDCAD traded at 1.2475.

Read more: USD/CAD Needs a Hawkish BOC For Losses to Continue

--- Written by Dylan Jusino, DailyFX Research