To get the Asia AM Digest every day, SIGN UP HERE

The Canadian Dollar plunged after officials from the country said they see rising odds of US President Donald leading his country out of the NAFTA regional free trade agreement. The British Pound also fell UK Chancellor of the Exchequer Philip Hammond and Brexit Secretary David Davis wrote in a joint article that the EU risks another global financial crisis if it doesn’t give London’s bankers a favorable trade deal.

The US Dollar traded mostly lower after officials from China were reportedly said to be viewing Treasury bonds as less attractive. The New Zealand Dollar managed to capitalize on the greenback’s woes as an alternative among the higher-yielding currencies in the G10 FX universe. The anti-risk Yen and Swiss Franc were best supported however as the sum of the day’s worrying headlines undermined overall sentiment.

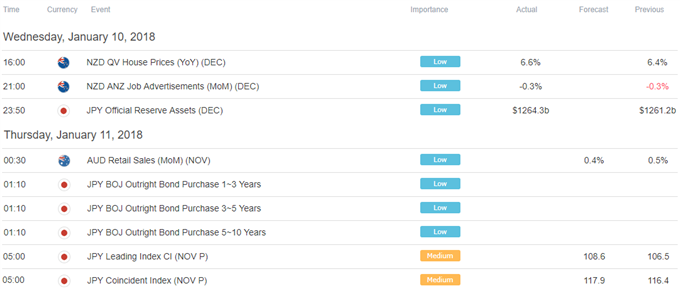

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

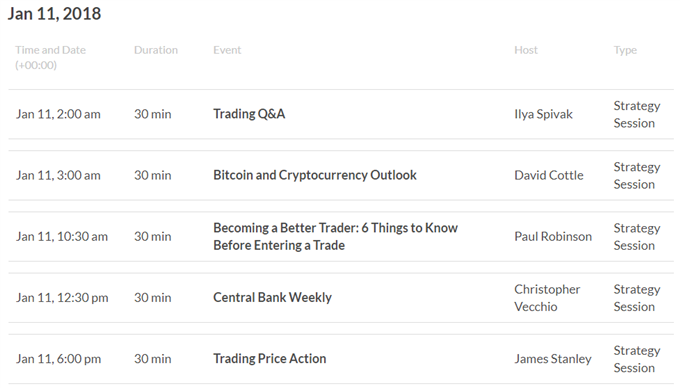

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

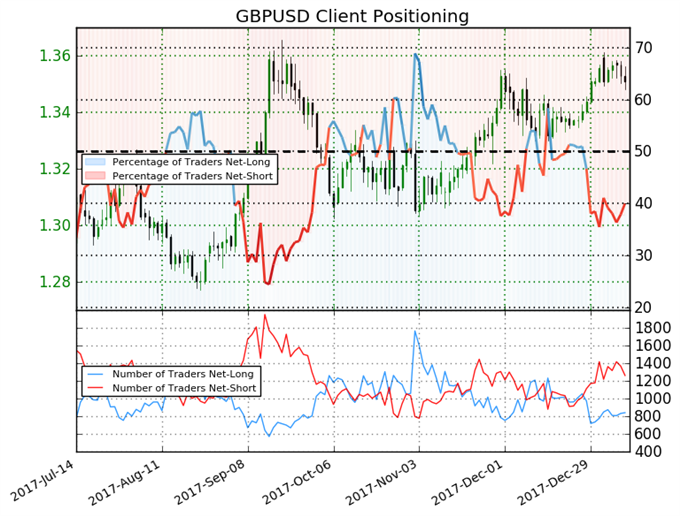

IG Client Sentiment Index Chart of the Day: GBP/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 40.0% of traders are net-long GBP/USD, with the ratio of traders short to long at 1.5 to 1. In fact, traders have remained net-short since Dec 28 when GBP/USD traded near 1.33732; price has moved 1.0% higher since then. The number of traders net-long is 5.7% lower than yesterday and 7.4% higher from last week, while the number of traders net-short is 11.4% lower than yesterday and 15.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- Near-term Setups in GBP/USD, GBP/JPY and AUD/USD by Michael Boutros, Currency Strategist

- EUR/USD Rate Outlook: Bullish RSI Formation Curbs Risk for Double-Top by David Song, Currency Analyst

- GBP/JPY Technical Analysis: Stealth Taper Worries Bring 300-Pip Pull-Back by James Stanley, Currency Strategist

- Cryptocurrency Volatility Likely to Remain High by Nick Cawley, Analyst

- Why Impact on USD of Surge in Treasury Yields Might be Limited by Martin Essex, MSTA

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here