To get the Asia AM Digest every day, SIGN UP HERE

A surge in US Treasury bond yields and a parallel steepening of the priced-in 2018 Fed rate hike path sent the US Dollar higher against most of its major counterparts. The move did not seem tied to any single development on the day’s calendar of scheduled event risk.

The Yen raced higher after the Bank of Japan bought fewer bonds than at its previous purchase operation, fueling speculation about a stealthy start to dialing back stimulus. The Swiss Franc plunged in the meanwhile, hinting at a possible re-shuffling of portfolios toward it as a carry funding currency alternative.

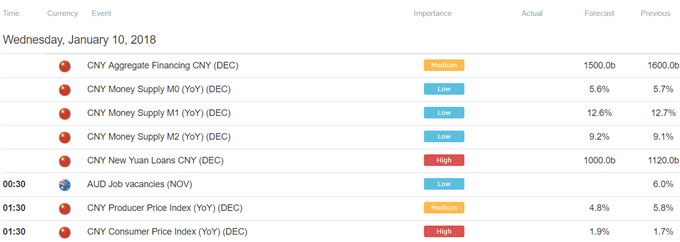

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

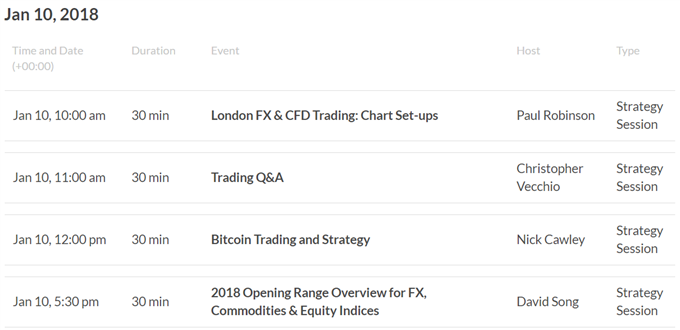

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

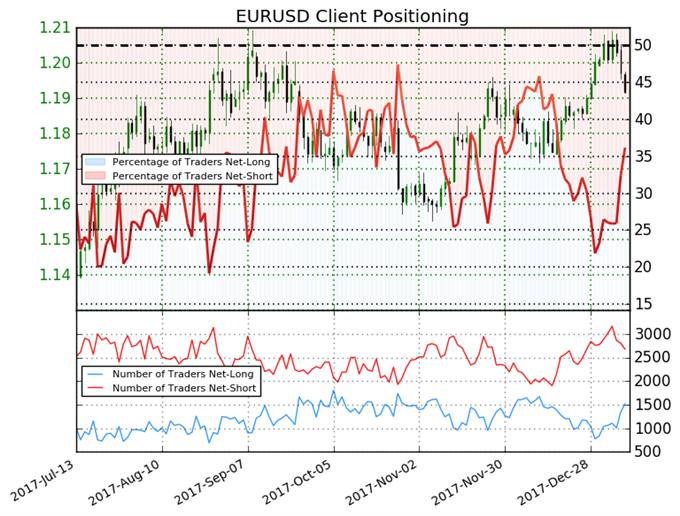

IG Client Sentiment Index Chart of the Day: EUR/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 36.2% of traders are net-long EUR/USD, with the ratio of traders short to long at 1.77 to 1. The percentage of traders net-long is now its highest since Dec 15 when EUR/USD traded near 1.17488. The number of traders net-long is 27.9% higher than yesterday and 40.5% higher from last week, while the number of traders net-short is 13.5% lower than yesterday and 8.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- AUD/USD Price Rally Vulnerable- Pullback to Offer Opportunity by Michael Boutros, Currency Strategist

- Canadian Dollar Rate Forecast: BoC Great Rate Hike Expectations by Tyler Yell, CMT

- Euro Correction Continues as USD Exhibits Bullish Momentum by James Stanley, Currency Strategist

- GBP Needs Strong UK Data to Underpin Next Leg Higher by Nick Cawley, Analyst

- USD/JPY Rate Forecast: Has The Silent BoJ Taper Begun? by Tyler Yell, CMT

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here