To get the Asia AM Digest every day, SIGN UP HERE

The US Dollar fell as 2018 got underway, losing ground against all of its G10 FX peers even as front-end Treasury bond yields rose and the priced-in rate hike path implied in Fed Funds futures steepened. That seems to point away from textbook fundamentals as the catalyst for the selloff. A parallel rise in US stocks hints it may reflect capital flows returning out of cash and into riskier assets after the New Year holiday.

The British Pound outperformed in a move that might have been corrective after the currency slid to a one-month low against its leading counterparts on last year’s final trading day. A retracement may have also explained a broad-based drop in the New Zealand Dollar. The island nation’s currency hit a two-month high against an average of the world’s top-traded alternatives in twilight hours of 2017.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

No data.

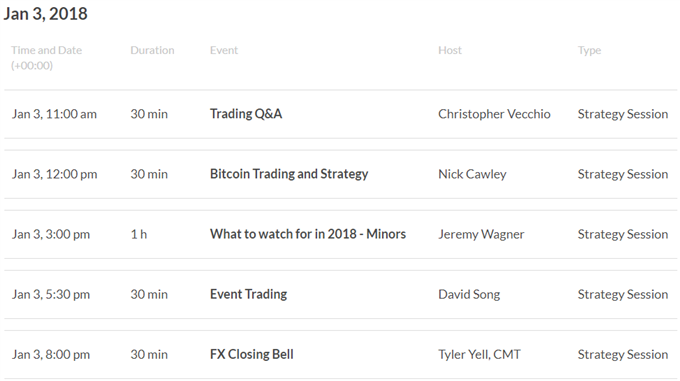

DailyFX Webinar Calendar – CLICK HERE to register (all times in GMT)

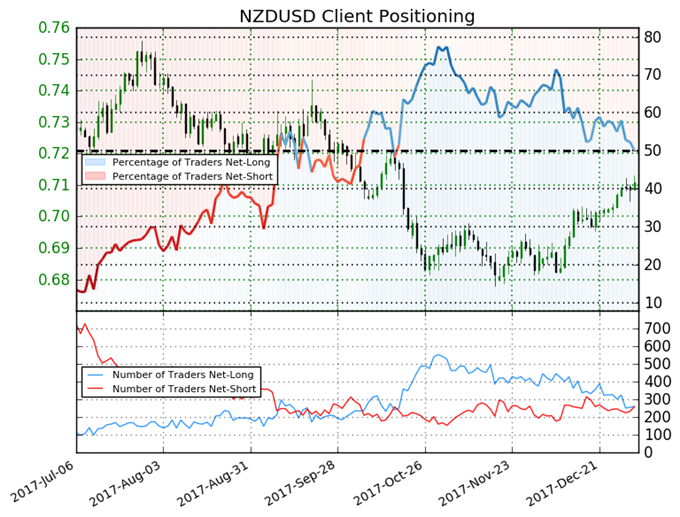

IG Client Sentiment Index Chart of the Day: NZD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 50.1% of traders are net-long NZD/USD, with the ratio of traders long to short at 1.0 to 1. The number of traders net-long is 2.4% higher than yesterday and 17.7% lower from last week, while the number of traders net-short is 13.6% higher than yesterday and 5.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading

- DailyFX Q1 2018 Forecasts: USD, Oil and Equities by DailyFX Research Team

- Euro May Top the List of Major Trend Reversals in 2018 by Ilya Spivak, Sr. Currency Strategist

- New Year Starts With USD Continuing to Fall by Martin Essex, MSTA

- EUR/USD Rate Outlook Supported by Bullish RSI Behavior by David Song, Currency Analyst

- Japanese Yen Could Rally Against the Dollar by Dylan Jusino, DailyFX Research Team

To get the Asia AM Digest every day, sign up here

To get the US AM Digest every day, sign up here

To get both reports daily, sign up here