Talking Points

- The Euro-Zone Sentix overall indicator falls.

- EUR/USD may continue to slip lower as US President Trump’s tax breaks near.

Check out our new Trading Guides: they’re free and have been updated for the fourth quarter of 2017

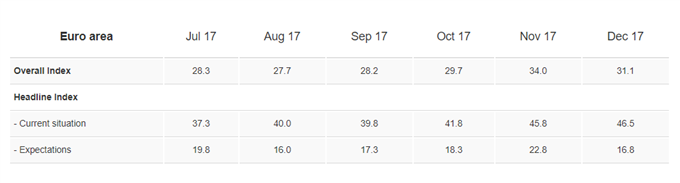

The latest Euro-Zone Sentix economic indicator fell in November, breaking a recent run of higher highs, with expectations leading the move lower. The overall index fell to 31.1 from 34.0 in the Euro-Zone, while in Germany the index fell to 39.1 from 42.4, with German politics beginning to weigh. Chancellor Angela Merkel has been unable to form a coalition government over the last few weeks and her Christian Democratic Union party is now back in talks with German Social Democratic Party leader Martin Schultz on possible options to break the current political stalemate.

The fall in the overall indicator is slightly worrying in light of the strong set of economic indicators coming out of Germany and the Euro-Zone. Growth continues to be upgraded, sentiment remains firm with only a lack of inflation in the Euro-Zone a negative for ECB President Mario Draghi.

The single currency has drifted lower in the last month against the US Dollar on expectations that US President Donald Trump’s tax reforms will be implemented. DailyFX analyst Paul Robinson highlighted recently that EUR/USD has been testing the November trend-line and this remains key in the near-term.

Chart: EURUSD Three Hour Time Frame (November 20 – December 4, 2017)

Would you like to know the Traits of Successful Traders and how to find the Number One Mistake Traders Make? If so, click here.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1