Get the Asia AM Digest every day before Tokyo equity markets open – sign up here !

The British Pound leads the way higher at start the trading week. The newswires cite a Times report quoting an unnamed European diplomat saying the issue of a Brexit “divorce bill” is basically solved while a deal on the post-Brexit role of the European Court of Justice is nearly there. The Euro is edging upward as well.

The US Dollar is also on the offensive after a last-minute deal allowed the US Senate to pass a tax cut plan on Friday. This brings the realization of fiscal stimulus that drives inflation higher and forces a steeper Fed rate hike cycle another step closer to fruition.

The prospect of higher rates in the US understandably weighed on the Australian and New Zealand Dollars. With the RBA and RBNZ seemingly in no hurry to tighten monetary policy, both currencies stand vulnerable of being unseated from their perch as the highest yielders in the G10 FX space.

Taken together, the prospect of a stimulus-driven jump in US demand coupled with easing EU/UK instability worries translated into swelling risk appetite. S&P 500 futures moved sharply higher and yields rose as capital poured out of the safety of Treasury bonds.

Not surprisingly, this sent funding and otherwise anti-risk currencies like the Japanese Yen and Swiss Franc lower. Gold prices also lost ground as higher lending rates undermined the appeal of non-interest-bearing assets epitomized by the yellow metal.

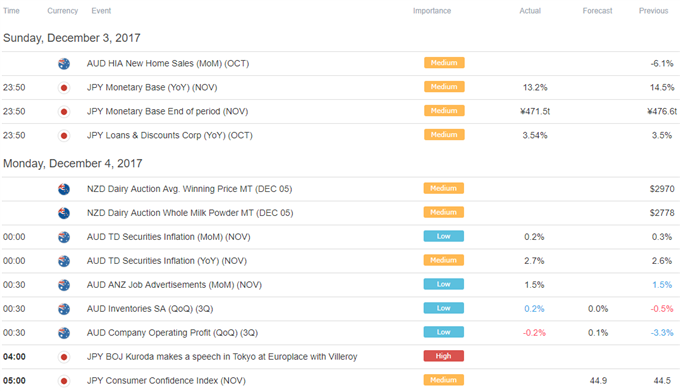

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

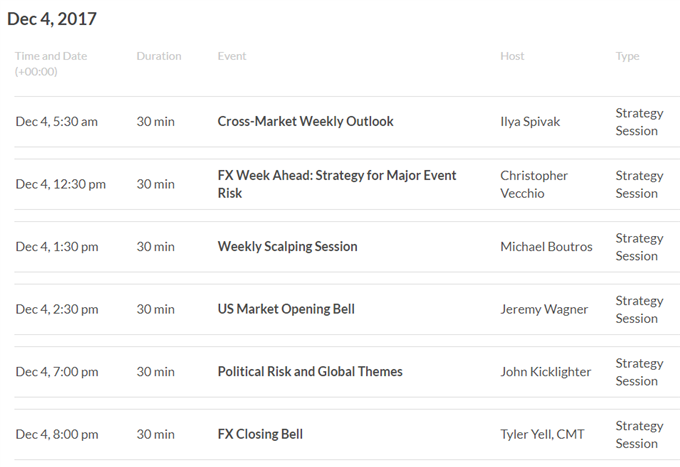

DailyFX Webinar Calendar – CLICK HERE to Register (all times in GMT)

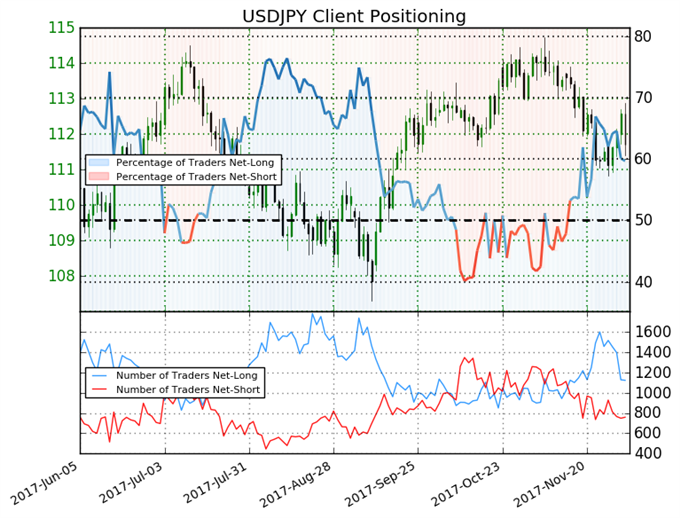

IG Client Sentiment Index Chart of the Day: USD/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 59.7% of traders are net-long USD/JPY, with the ratio of traders long to short at 1.48 to 1. In fact, traders have remained net-long since Nov 15 when USD/JPY traded near 113.413; price has moved 1.5% lower since then. The number of traders net-long is 14.0% lower than yesterday and 30.0% lower from last week, while the number of traders net-short is 9.2% lower than yesterday and 9.4% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse higher despite the fact traders remain net-long.

Five Things Traders are Reading

- Weekly Forecast: US Political Headlines, Brexit Negotiation and Rate Decisions Ahead by DailyFX Research Team

- Whether Traditional, Monetary Policy or Political Risk; Gold Is a Haven by John Kicklighter, Chief Currency Strategist

- Flynn Testimony and Tax Headlines Offset for S&P 500, Compound for Dollar by John Kicklighter, Chief Currency Strategist

- EUR/USD Weekly Technical Analysis: Euro Shows Moxie at Support by Paul Robinson, Market Analyst

- Foundations of Technical Analysis: Turning Observations into a Trade by Michael Boutros, Currency Strategist

To get the Asia AM Digest every day before the Tokyo cash equity open, sign up here

To get the US AM Digest every day before the US cash equity open, sign up here

To get both reports daily, sign up here