Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The US Dollar is catching a small bid at the cash equity open in New York, with both the British Pound and the Euro, two of the main drivers of greenback losses in recent days, slipping back. Tax reform headlines continue to dominate the conversation in the United States, with the US Senate looking to hold a vote later this morning on the Senate Republican bill. Overall, FX markets are proving quiet at the start of the new months, as traders ready for a more interesting week next week (RBA, BOC, US NFPs).

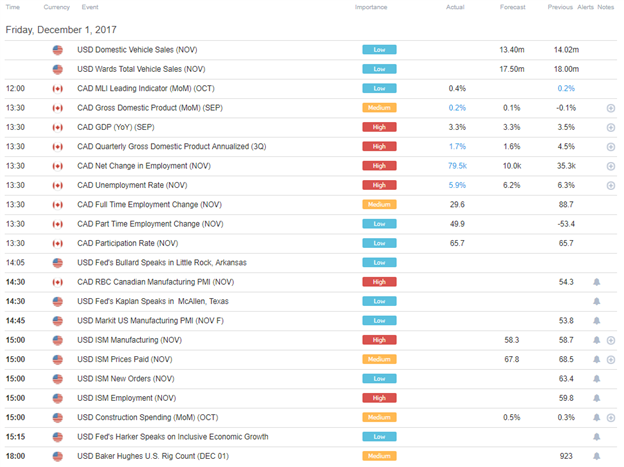

DailyFX Economic Calendar: Friday, December 1, 2017 – North American Releases

The significant Canadian economic data is behind us for the day, with upside surprises abound. Notably, the November Canadian jobs report was significantly stronger than anticipated, with the headline figure coming in at +79.5K versus +10K expected, and the unemployment rate dropping to 5.9% from 6.3%. USD/CAD quickly reversed the past three days gains and is back near Monday’s close.

Later today, the November US ISM Manufacturing report will be released, one of the two ISM surveys used as contemporaneous indicators with the Nonfarm Payrolls report. October US Construction Spending figures will also be released. Two Fed speakers are on the day as well, with the Fed’s Kaplan speaking at 9:30 EST/14:30 GMT and the Fed’s Harker speaking at 10:15 EST/15:15 GMT.

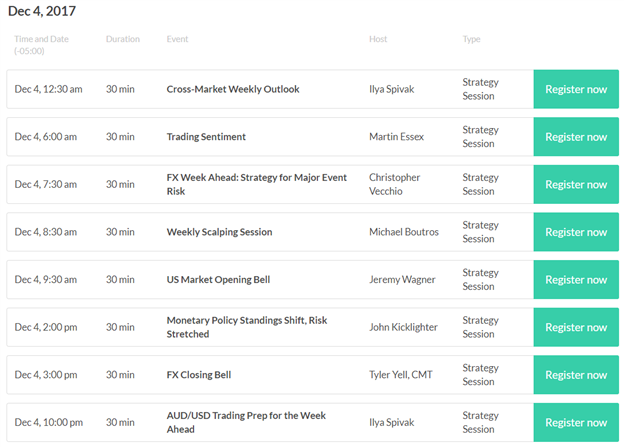

DailyFX Webinar Calendar: Monday, December 4, 2017

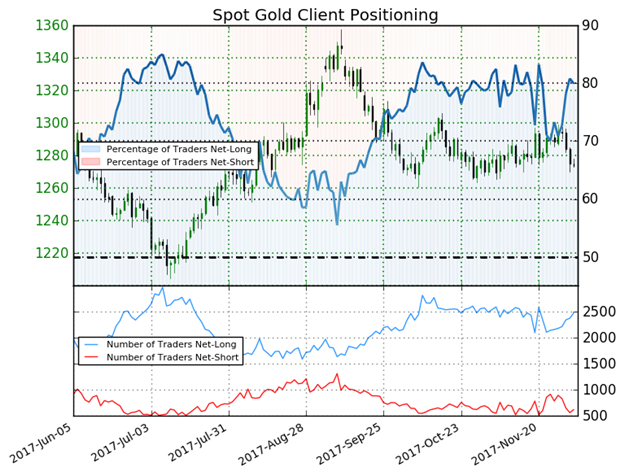

IG Client Sentiment Index Chart of the Day: Spot Gold

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

Spot Gold: Retail trader data shows 80.0% of traders are net-long with the ratio of traders long to short at 3.99 to 1. The number of traders net-long is 5.3% higher than yesterday and 13.5% higher from last week, while the number of traders net-short is 12.7% lower than yesterday and 32.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Spot Gold-bearish contrarian trading bias.

Five Things Traders are Reading

- “Canadian Economy Grows 1.7%, Unemployment Falls to Lowest Since 2008” by Dylan Jusino, DailyFX Research

- “US Dollar Starts December on Shaky Footing” by Christopher Vecchio, CFA, Senior Currency Strategist

- “Technical Outlook for Euro, Sterling, Yen (Crosses), Gold & More” by Paul Robinson, Market Analyst

- “S&P 500 & Dow Jones Show Short-term Blow-off Top in the Works” by Paul Robinson, Market Analyst

- “Bitcoin’s Indecision Points to Further Downside” by Nick Cawley, Analyst

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.