Get the Asia AM Digest every day before Tokyo equity markets open – sign up here !

The New Zealand Dollar traded broadly lower yesterday, sustaining a move that started in Asia Pacific hours that appeared to reflect a move out of cash and into riskier NZD-denominated assets. This might reflect ebbing political worries that had been triggered by Labour’s shock triumph in post-election coalition talks. Perhaps Prime Minister Jacinda Ardern’s spat with previously friendly Greens over their refusal to ratify a revised TPP trade agreement hinted that the new government might be less radical than some feared.

The Swiss Franc was the weakest on the day however as global share prices recovered after the previous day’s losses. The currency seems to have recovered a degree of haven appeal, making it vulnerable at times when investors’ mood brightens. The inverse correlation between an average of the Franc’s value against its major counterparts and the MSCI World Stock index now at a formidable 0.72 on 20-day percent change studies having been virtually nonexistent just three week ago. The similarly low-yielding Euro and JapaneseYen likewise suffered, with the swell I risk appetite proving broadly negative for funding FX.

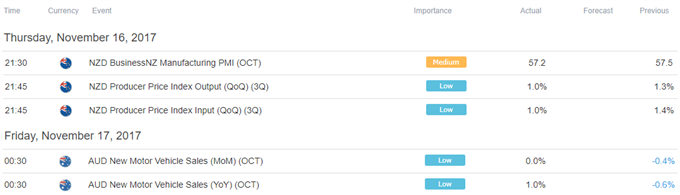

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

DailyFX Webinar Calendar– 17 October 2017

London FX and CFD Trading (10:00 GMT) with Paul Robinson

Key UK Events and Markets for the Week Ahead (11:30 GMT) with Nick Cawley

The Foundations of Technical Analysis (15:30 GMT) with Michael Boutros

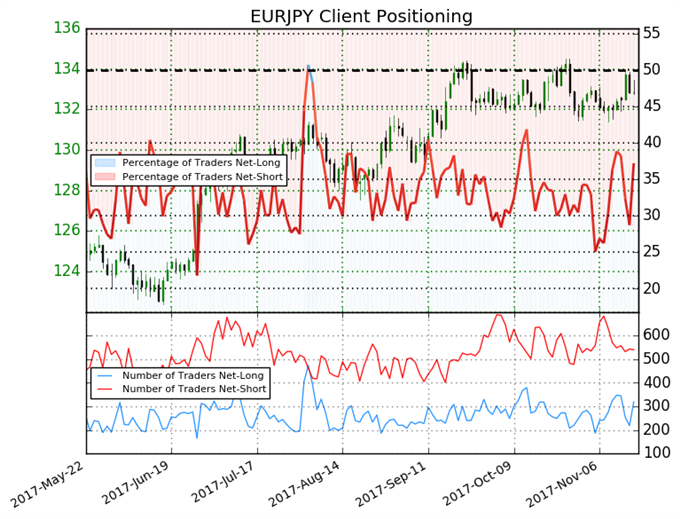

IG Client Sentiment Index Chart of the Day: EUR/JPY

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 37.2% of traders are net-long EUR/JPY, with the ratio of traders short to long at 1.69 to 1. In fact, traders have remained net-short since Aug 04 when EUR/JPY traded near 129.449; price has moved 2.6% higher since then. The number of traders net-long is 29.0% higher than yesterday and 4.5% lower from last week, while the number of traders net-short is 4.9% lower than yesterday and 9.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/JPY price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- Becoming a Better Trader: Classic Chart Patterns (Part II) by Paul Robinson, Market Analyst

- EUR/USD: Setups on Both Sides as USD Strength the Big Question by James Stanley, Currency Strategist

- NZD/JPY Range Break Targets Fresh Monthly Lows by Michael Boutros, Currency Strategist

- BOE’s Carney Reassures Over Brexit Risks, Sterling Emboldened by Nick Cawley, Analyst

- USD/JPY Strategy: Triple Top Looks to Be Set Below 115.00 Figure by Ilya Spivak, Sr. Currency Strategist

To get the Asia AM Digest every day before the Tokyo cash equity open, sign up here

To get the US AM Digest every day before the US cash equity open, sign up here

To get both reports daily, sign up here