Talking Points

- The palladium market is small and illiquid so sharp setbacks are always possible.

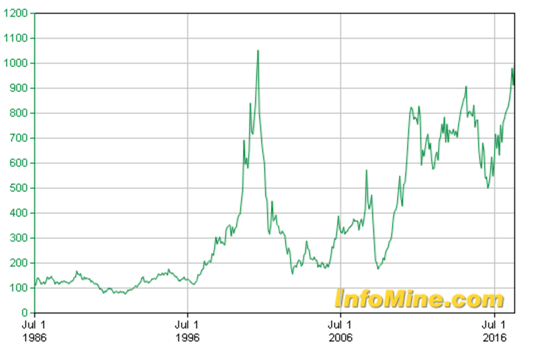

- However, the price’s rapid advance to its highest level since February 2001 can be justified by tight supplies and rising demand for the precious metal.

What Does the Fourth Quarter Hold for Gold, Oil, Equities and Other Key Markets? Find out here

The price of palladium has surged in recent months to its highest level for more than 16 years as robust demand has met tight supplies of the precious metal, which is used principally in catalytic converters for petrol/gasoline-engined cars/autos.

Chart: Palladium Price, Monthly Timeframe (1986 – 2017)

In Europe in particular, petrol engines have become more popular and diesel engines less so as concern grows about emissions from the latter, which tend to use platinum rather than palladium in their catalytic converters. In addition, car sales in China are growing robustly and hybrids, which run on both electricity and petrol rather than diesel, are becoming more common. In addition, supplies – principally from Russia and South Africa – are tight.

As a result, the price of palladium overtook the price of platinum in late September and palladium is now trading well above the $1,000/ounce level.

Chart: Palladium Price, Daily Timeframe (2017 to Date))

The market for palladium is small and illiquid so there is always a risk of a sharp short-term correction but if current trends continue the price could yet advance further. The key is to watch car sales data closely as higher sales of petrol-engined cars and hybrids should continue to spur demand.

--- Written by Martin Essex, Analyst and Editor

To contact Martin, email him at martin.essex@ig.com

Follow Martin on Twitter @MartinSEssex

For help to trade profitably, check out the IG Client Sentiment data

And you can learn more by listening to our regular trading webinars; here’s a list of what’s coming up

Check out our Trading Guides: Several new ones are now available including Forex for Beginners, Building Confidence and Traits of Successful Traders

Like to know about the Traits of Successful Traders? Just click here

Or New to Forex? That guide is here