Receive the DailyFX US AM Digest in your inbox every day before US equity markets open - signup here

The US Dollar (via DXY Index) has seen its losses from Wednesday, triggered by a round of US weaker than expected housing data, trickle into Thursday absent any new bullish developments in the past 24-hours otherwise. As September US economic data has started to roll in, it’s becoming increasingly clear that Hurricanes Harvey and Irma will have had a materially negative impact on Q3’17 GDP. Yesterday, the Atlanta Fed, New York Fed, and St. Louis Fed all downgrading their Q3 US GDP estimates after Wednesday’s data.

Ahead of the US open, the US Dollar’s weakness after Wednesday’s data has been reinforced by a pullback in US Treasury yields. The US Treasury 2-year yield is down 3-bps today after rising to its highest level of the year yesterday, and its highest level since 2008.

The Euro continues to drift higher as traders stake out positions ahead of the ECB’s October policy meeting, one week from today. The Catalan independence movement appears to be evolving into a new phase of struggle between the regional Catalonia government and the federal Spanish government, but thus far the probability of contagion is low and thus any impact has been contained locally to Spanish Bonos and the IBEX 30.

The British Pound slipped earlier following a round of retail sales data that showed consumption trends are weaker than anticipated. Like the US economy, nearly 70% of headline UK GDP comes from consumption. The combination of higher inflation and weaker consumption may create a policy dilemma for the Bank of England, throwing a wrench into their best laid plans to raise rates in November.

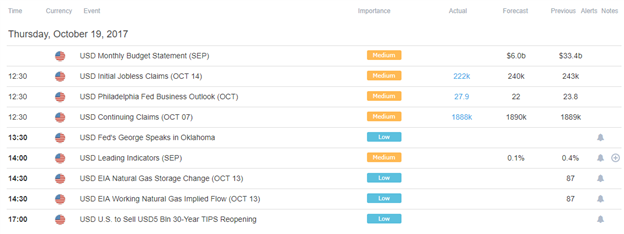

DailyFX Economic Calendar: Thursday, October 19, 2017 – North American Releases

The North American calendar is one-sided today, with no releases due from Canada. Despite a sizeable flow of data and information, however, there are no ‘high’ importance events from the United States. As such, with the upcoming data releases more interesting from an ‘economics’ rather than a ‘trading’ point of view, the US Dollar will likely brush aside any short-term influences today’s data releases bring.

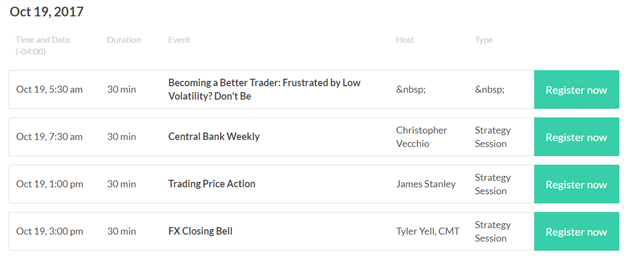

DailyFX Webinar Calendar: Thursday, October 19, 2017

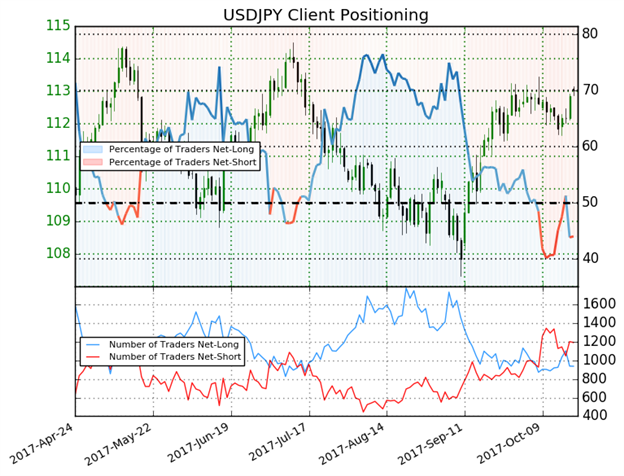

IG Client Sentiment Index Chart of the Day: USDJPY

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

USDJPY: Retail trader data shows 44.0% of traders are net-long with the ratio of traders short to long at 1.27 to 1. The number of traders net-long is 17.1% lower than yesterday and 5.7% higher from last week, while the number of traders net-short is 12.5% higher than yesterday and 10.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDJPY prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USDJPY trading bias.

Five Things Traders are Reading

- “US Dollar Taking Cues from Other Major Currencies” by Christopher Vecchio, CFA, Senior Currency Strategist

- “GBP/USD Hits a One-Week Low on Dismal Retail Sales Data” by Nick Cawley, Analyst

- “DAX Extends into Top-Side Trend-lines, Reversal Underway” by Paul Robinson, Market Analyst

- “Asian Stocks Mixed As China GDP Hits Forecasts, NZ Gets New Govt” by David Cottle, Analyst

- “GBP/USD Technical Analysis: Clinging to Longer-Term Support Zone” by James Stanley, Currency Strategist

The DailyFX US AM Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Asia AM Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.