Get the Asia AM Digest every day before Tokyo equity markets open – sign up here !

The US Dollar continued to retreat as minutes from September’s FOMC meeting revealed lingering concerns about sluggish inflation even as policymakers angle to raise rates again in December. The markets may have read that as implying a flatter tightening path in 2018.

The Japanese Yen declined as stocks firmed, undermining the appeal of the perennially anti-risk currency. The Canadian Dollar pushed higher as Prime Minister Justin Trudeau offered encouraging comments on the fate of the NAFTA free trade agreement after a meeting with US President Trump in Washington DC.

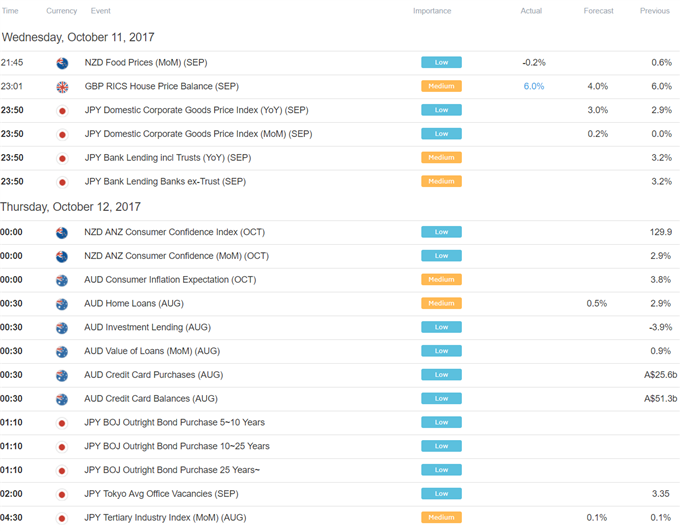

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

A seemingly busy economic calendar in Asia Pacific trading hours offers few truly market-moving releases. Japanese CGPI data – a measure of wholesale inflation akin to PPI – is expected to show a slight pickup that will probably be ignored by the BOJ and so pass with little fanfare. Australian home loan figures may also pass unnoticed as the RBA remains committed to a wait-and-see approach in the near term.

A report on New Zealand consumer confidence from ANZ Bank might be the most noteworthy bit of event risk. The October survey might reveal the extent to which political uncertainty in the wake of an inconclusive general election is likely to weigh on economic activity. A drop signaling a further delay of any potential RBNZ tightening may weigh on the Kiwi Dollar, while a firm print might relieve some recent pressure.

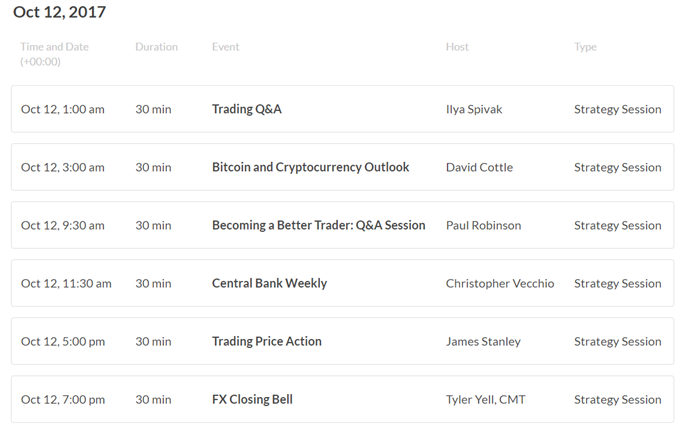

DailyFX Webinar Calendar – CLICK HERE to register

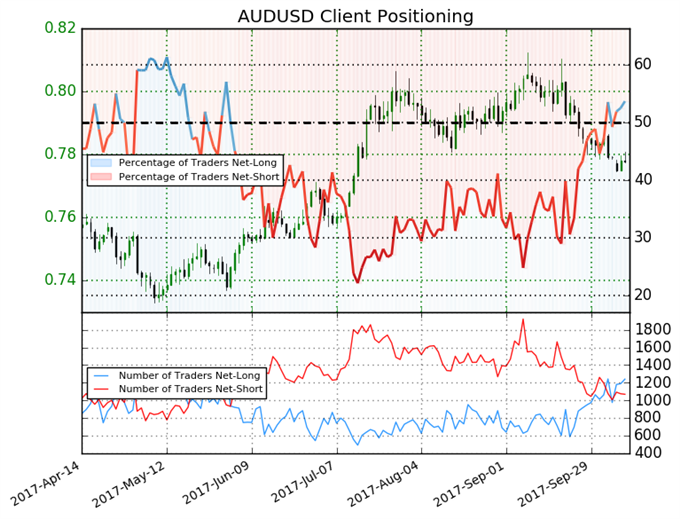

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 53.7% of traders are net-long AUD/USD, with the ratio of traders long to short at 1.16 to 1. The number of traders net-long is 1.7% higher than yesterday and 14.7% higher from last week, while the number of traders net-short is unchanged than yesterday and 10.2% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD -bearish contrarian trading bias.

Five Things Traders are Reading

- US Dollar Slips as September FOMC Minutes Reveal Concern Over Inflation by Christopher Vecchio, CFA, Sr. Currency Strategist

- GBP/JPY Technical Analysis: Bull Flag After Fresh One-Year Highs by James Stanley, Currency Strategist

- Bitcoin Prices Eye Record High – Pullbacks to Offer Opportunity by Michael Boutros, Currency Strategist

- EUR/USD Topside Targets Back on Radar Amid Failure to Test August-Low by David Song, Currency Analyst

- Euro and Spanish Assets Rally as Catalonia Fears Fade by Martin Essex, MSTA, Analyst and Editor

The Asia AM Digest is published every day before the Tokyo cash equity open - you can sign up here to receive that report in your inbox every day. The US AM Digest is published every day before the US cash equity open - you can sign up here to receive this report in your inbox every day.

If you're interested in receiving both reports each day, you can sign up here.