Get the Asia AM Digest every day before Tokyo equity markets open – sign up here !

The US Dollar continued to correct broadly lower against the majors, marking the first net loss against an average of its top counterparts in four days. The magnitude of the decline seems to put it squarely in corrective territory. Indeed, this was the smallest downtick since the near-term uptrend began two weeks ago.

Tellingly, the lion’s share of the greenback’s slide came before the day’s offering of US economic news-flow. Almost all of those losses were erased after the ADP gauge of US employment growth registered in line with expectations while the service-sector ISM survey proved to be far more upbeat than analysts projected.

The yields-sensitive Australian Dollar led the way higher. The move mirrored a drop in front-end US bond yields, highlighting the centrality of Fed rate hike bets as driving catalyst. The Aussie was perhaps best placed to capitalize after the RBA opted against dialing up FX intervention threats at its monetary policy announcement earlier in the week.

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

The data docket is decidedly lackluster in Asia Pacific trading hours, with a pair of Australian releases amounting to the only items of note. Recent economic news-flow out of the “lucky” country has somewhat undermined the moniker: it has underperformed relative to consensus forecasts since mid-June.

This warns that analysts are overestimating the economy’s vigor, opening the door for downside surprises. While that may sting the Aussie Dollar in the near term, the RBA’s firm stance on the sidelines undermines the outcomes’ implications for near-term policy trends, meaning follow-through may be hard to come by.

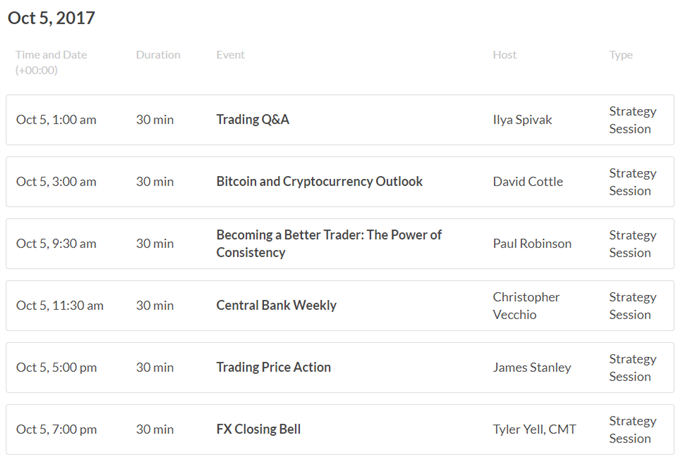

DailyFX Webinar Calendar – CLICK HERE to register

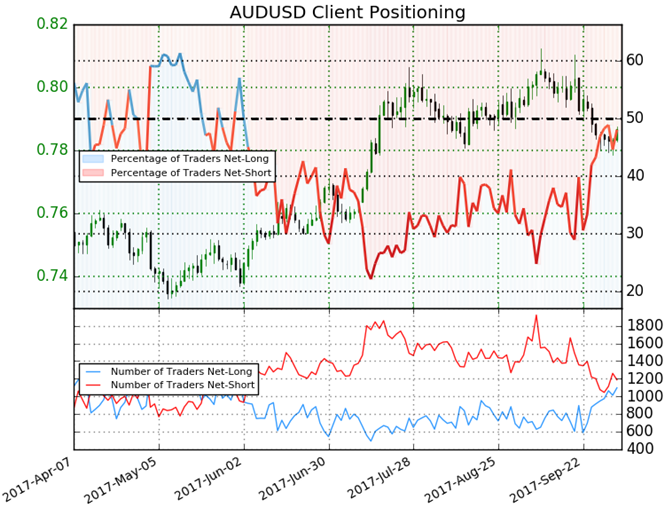

IG Client Sentiment Index Chart of the Day: AUD/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 48.0% of traders are net-long AUD/USD, with the ratio of traders short to long at 1.08 to 1. The number of traders net-long is 8.6% higher than yesterday and 20.9% higher from last week, while the number of traders net-short is 1.3% higher than yesterday and 8.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- GBP/USD Technical Analysis: Is the Bullish Trend Ready to Resume? by James Stanley, Currency Strategist

- Crude Oil Price Analysis– Losses to Persist Near-Term by Michael Boutros, Currency Strategist

- EUR/USD Outlook Mired Ahead of NFP Amid Mixed ECB Rhetoric by David Song, Currency Analyst

- Strong ISM Services Provide Further Support For USD Turn by Tyler Yell, CMT

- GBP/USD Rises as UK Services PMI Beats Expectations by Martin Essex, Analyst and Editor

The Asia AM Digest is published every day before the Tokyo cash equity open - you can sign up here to receive that report in your inbox every day. The US AM Digest is published every day before the US cash equity open - you can sign up here to receive this report in your inbox every day.

If you're interested in receiving both reports each day, you can sign up here.