Receive the DailyFX Morning Digest in your inbox every day before US equity markets open - signup here

The DXY Index is pushing to its highest level in five weeks, gaining ground across the board as the new week, month, and quarter begin. The Euro is softer this morning after the Catalonian independence referendum vote yesterday, in which a stunning 89% of voting participants opted for secession. Yet with the federal Spanish government calling the vote “illegal,” and the supranational European Commission deferring management of the situation to the Mariano Rajoy-led government, it seems a new, negative political catalyst has emerged. Elsewhere, the Australian Dollar is trading slightly lower on the data ahead of the October Reserve Bank of Australia rate decision tomorrow.

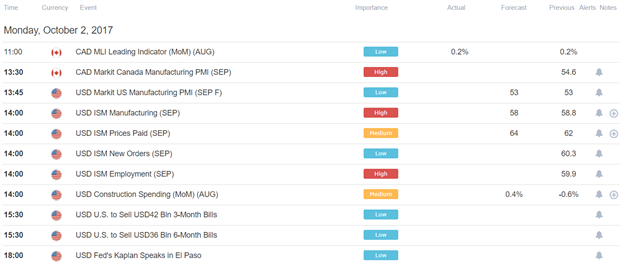

DailyFX Economic Calendar: Monday, October 2, 2017 - North American Data Releases

There are several data releases out of the United States this morning and two out of Canada. And while some of these events are historically considered ‘high’ importance releases, recently, they have not been recently. This commentary mainly applies to the US ISM Manufacturing Index (SEP), which falls into the category of ‘soft data’: it is a sentiment reading, not a report on real economic activity. With a noticeable divide in ‘soft’ and ‘hard’ data – confidence is up among businesses and consumers, but no material bump in economic activity has followed – traders are likely to downgrade the importance of today’s US economic releases.

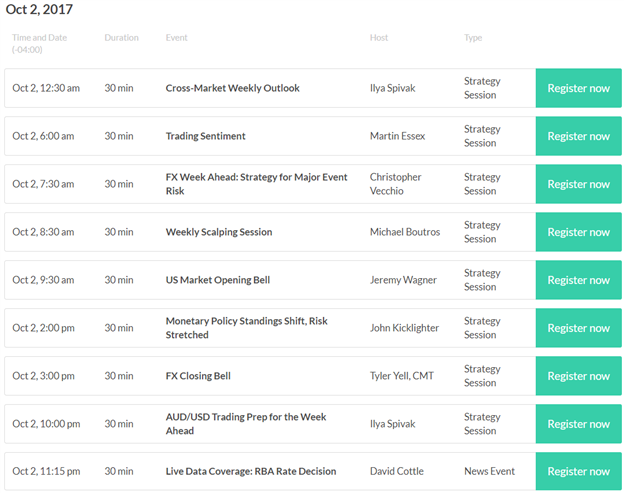

DailyFX Webinar Calendar: Monday, October 2, 2017

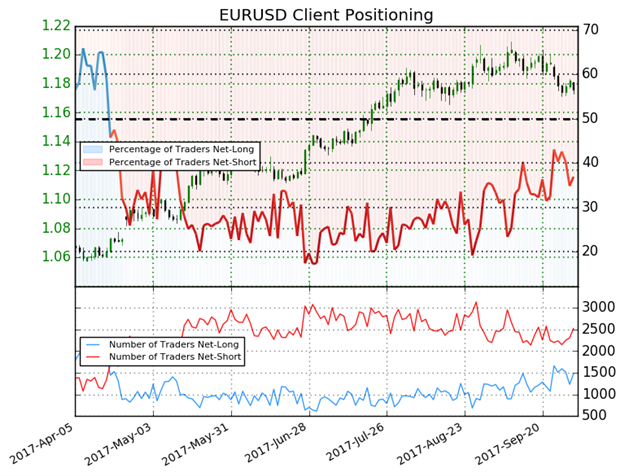

IG Client Sentiment Index Chart of the Day: EURUSD

Learn more about the IG Client Sentiment Index on the DailyFX Sentiment page

EURUSD: Retail trader data shows 36.9% of traders are net-long with the ratio of traders short to long at 1.71 to 1. In fact, traders have remained net-short since Apr 18 when EURUSD traded near 1.07831; price has moved 9.0% higher since then. The number of traders net-long is 6.0% higher than yesterday and 22.0% higher from last week, while the number of traders net-short is 6.2% higher than yesterday and 4.4% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Five Things Traders are Reading

- “AUDUSD Options Pricing in Muted Price Movement Week of RBA Meeting” by Paul Robinson, Market Analyst

- “FX Markets Look to RBA Rate Decision on Tuesday, US NFPs on Friday” by Christopher Vecchio, CFA, Senior Currency Strategist

- “British Pound, US Dollar May Rise on Upbeat Manufacturing Data” by Ilya Spivak, Senior Currency Strategist

- “COT Report: Euro, CAD & AUD Large Spec Buyers Undeterred by Weakness” by Paul Robinson, Market Analyst

- “What Does the Fourth Quarter Hold for the Dollar, Equities, Oil and Other Key Markets?” by DailyFX Research Team

The DailyFX Morning Digest is published every day before the US cash equity open - you can SIGNUP HERE to receive this report in your inbox every day.

The DailyFX Evening Digest is published every day before the Tokyo cash equity open - you can SIGNUP HERE to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can SIGNUP HERE.