Get the DailyFX Asia AM Digest every day before Tokyo equity markets open – SIGN UP HERE !

The US Dollar returned to the offensive against most of its major counterparts on Friday, rising against a backdrop of firming front-end Treasury bond yields as the priced-in Fed rate hike outlook continued to steepen. Only the Euro and the Swiss Franc managed to edge ahead of the greenback, shrugging off disappointing Eurozone CPI data that might’ve been expected dent the case for tapering ECB QE (at least in the near term).

The single currency remains surprisingly well-supported at the start of the new trading week despite political instability in Spain, where police clashed with Catalan voters taking part in an independence referendum opposed by the government in Madrid. The sentiment-linked Australian and New Zealand Dollars are enjoying early gains while the anti-risk Yen is under pressure following upbeat Chinese PMI statistics published over the weekend.

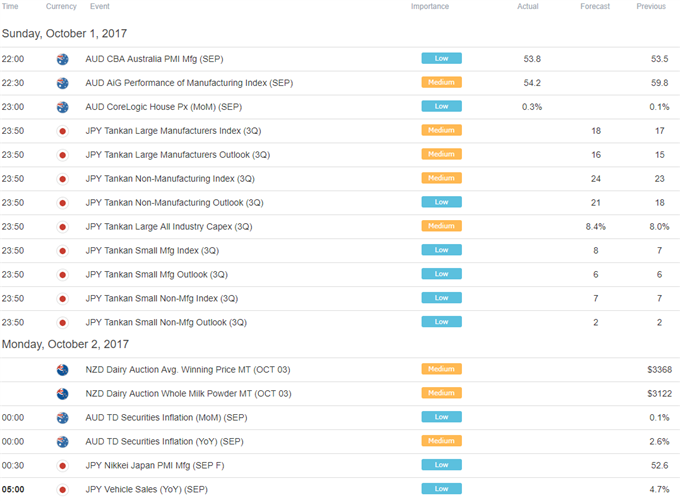

DailyFX Economic Calendar: Asia Pacific

Holiday market closures in China, Hong Kong and India along with a lull in top-tier economic news flow might make for a relatively quiet session in Asia Pacific hours.

Japan’s third-quarter Tankan business confidence survey amounts to the standout on the data docket. Consensus forecasts call for narrow improvement but this may not inspire lasting follow-through from the Yen considering their limited implications for BOJ policy bets. Indeed, the central bank floated the possibility of expanding its already aggressive stimulus effort just last week.

On balance, this might mean that sentiment trends remain at the forefront. FTSE 100 and S&P 500 stock index futures are pointing higher, hinting that a risk-on mood may continue to prevail. The absence of a clear-cut focal point and comparatively thinner liquidity conditions might make markets especially sensitive to headline risk however, warning investors to be especially mindful of kneejerk volatility.

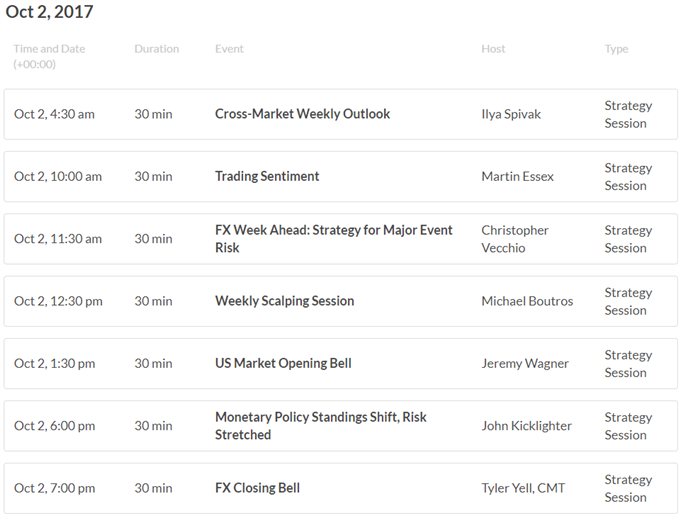

DailyFX Webinar Calendar – CLICK HERE to register

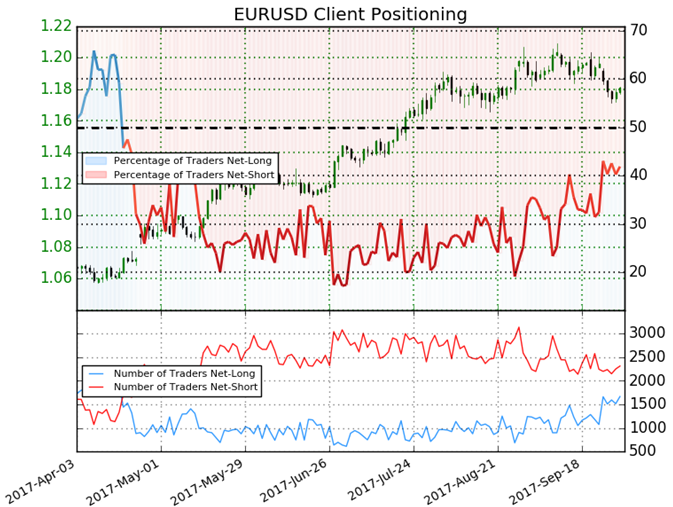

IG Client Sentiment Index Chart of the Day: EUR/USD

CLICK HERE to learn more about the IG Client Sentiment Index

Retail trader data shows 41.9% of traders are net-long EUR/USD, with the ratio of traders short to long at 1.39 to 1. In fact, traders have remained net-short since Apr 18 when EUR/USD traded near 1.07974; price has moved 9.4% higher since then. The number of traders net-long is 7.1% higher than yesterday and 43.4% higher from last week, while the number of traders net-short is 5.7% higher than yesterday and 9.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

Five Things Traders are Reading

- Euro Steady In Asia As Catalan Independence Vote Rocks Spain by David Cottle, Analyst

- What Does the Fourth Quarter Hold for the Dollar, Equities, Oil and Other Key Markets? by the DailyFX Research Team

- Australian Dollar Must Await RBA Which May Try Talking It Down by David Cottle, Analyst

- Big-picture Technical Analysis for USD, Euro, Gold, Oil & S&P 500 by Paul Robinson, Market Analyst

- US Dollar Slips as Core PCE, Fed’s Preferred Gauge of Inflation, Misses by Dylan Jusino

The DailyFX US AM Digest is published every day before the US cash equity open - you can sign up here to receive this report in your inbox every day. The Asia AM Digest is published every day before the Tokyo cash equity open - you can sign up here to receive that report in your inbox every day.

If you're interested in receiving both reports each day, you can sign up here.