Talking Points:

- Bullard, Evans weigh in on future policy

- Evans ready to begin balance-sheet unwind in September

- Some risk Fed has been too aggressive in tightening according to Bullard

See how the trading community views the US Dollar at the DailyFX Sentiment Page.

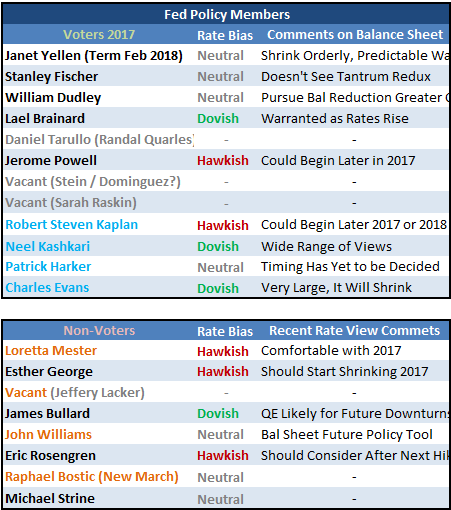

Federal Reserve members Charles Evans and James Bullard weighed in on the future on FOMC policy today. The comments revealed a divide from the Fed members in the pace seen appropriate for policy tightening, and the time to begin trimming its $4.5 trillion balance-sheet.

Chicago Fed President Evans stated today that despite concerns over low inflation, September would be appropriate for the central bank to begin to unwind its balance-sheet, and December a suitable time frame for the fifth rate hike. Evans believes waiting until December gives the Fed enough time to assess whether inflation will resume moving toward the Fed’s 2 percent annual target. It is worth noting that Evans was until a short time ago one of the Fed’s most dovish voices, yet now seems to support the more rapid timing for the balance-sheet adjustment and tightening pace in the group.

In contrast, St. Louis Fed President Bullard counseled patience today. He confidently repeated that he believes the level for the Fed’s key interest rate is appropriate near term, and that the Fed has been overly hawkish with regard to future policy. Bullard is concerned that inflation expectations have dropped since the FOMC began its tightening cycle, and that Fed inflation misses undercut their credibility. The non-voter also weighed in on the US Dollar saying that a weak dollar does make sense as the Euro strengthens alongside Europe’s economy and the ECB’s conviction. He also made an unusual venture into the capital market when he said the Fed has been reluctant to target equity prices.

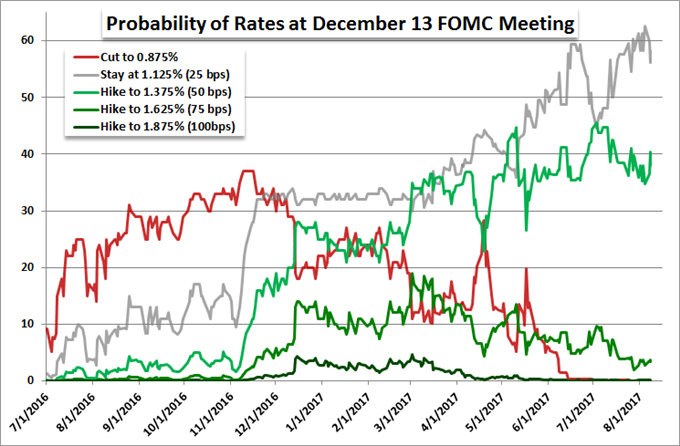

Despite the FOMC’s own concensus forecast for a third rate hike before the end of this year, Fed Fund futures show that the market predicts little more than a 40 percent change of the fifth hike in the series by the December 13 meeting. Further out, the FOMC has anticipated rates to be 100 basis points higher than the current 1.00 to 1.25 percent benchmark range (3 rate hikes after a predicted move later this year) by the close of 2018, but the same futures show only an 82 percent chance of even one 25 basis point move over the next 16 months.