Talking Points

- The Australian Dollar was little changed against its major peers on house price index readings

- Dwelling costs rose 4.1% (YoY) and 2.0% (QoQ) versus 5.1% and 2.8% expected respectively

- This week’s Fed interest rate decision could offer volatility for the sentiment-linked Aussie unit

Having trouble trading the Australian Dollar? This may be why.

The Australian Dollar showed a reserved reaction to worse than expected house price inflation readings. Dwelling costs rose 4.1% (YoY) and 2.0% (QoQ) in the second quarter 2016 versus 5.1% and 2.8% expected versus 6.8% and -0.2% in the first quarter respectively. The year-to-date reading not only clocked in at its lowest point since March 2013, but also declined for a third consecutive month from September 2015 highs.

In context, the data appears to fall in line with the Reserve Bank of Australia’s outlook for the housing market and its wait-and-see approach to interest rates. In its most recent monetary policy announcement, the RBA stated that the best available information suggested that the growth in lending for housing purposes has slowed. All else being equal, if demand for housing slows, the prices for them should soon follow.

Looking ahead, this week’s Fed interest rate decision is on the docket. As Currency Strategist Ilya Spivak noted, the sentiment linked Australian Dollar is at the mercy of risk trends and the relative yields outlook as driven by updated economic and rate path forecasts to be released with this week’s FOMC announcement.

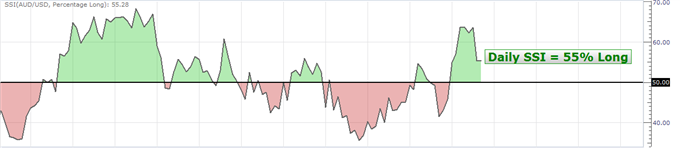

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing a reading that roughly 55 percent of open speculative retail positions in AUD/USD are long on a daily chart. The SSI is typically a contrarian indicator, implying further AUD/USDweakness ahead.

Want to learn more about the DailyFX SSI indicator? Click here to watch a tutorial.