Talking Points:

- The Australian Dollar little changed versus other major currencies, short term outlook here

- RBA keeps cash rate at record low 1.50%, as expected

- RBA says an appreciating exchange rate could complicate necessary economic adjustments

Learn good trading habits with the “Traits of successful traders” series

The Australian Dollar was little changed versus other major currencies (at the time this report was written) after today’s Reserve Bank of Australia (RBA) rate decision saw interest rates unchanged at record low 1.50%, as was expected by economists, with the rate seen by the RBA as “consistent with sustainable growth in the economy and achieving the inflation target over time”.

With the decision highly expected, attention quickly turned to the press release for further information.

Looking into the statement, the RBA repeated remarks on inflation, which remains “quite low” due to subdued growth in labour costs and very low cost pressures globally, and the bank expects this to remain the case for some time.

The RBA commented that lower rates are supporting domestic demand, but an appreciating exchange rate could complicate necessary economic adjustments.

Further adding to the perceived dovish lean were remarks on the housing market, emphasizing higher lending standards and incoming “considerable supply”.

Taken together, this might have been a hint for potential scope to cut rates down the line.

Last time the RBA cut, the market went on a “rate cut rally”, as we suspected, apparently on a search for yield basis in a record low rates environment.

The currency’s strength has been a headwind for the Australian economy, as was stated by the bank, but with the prospects of potential rate hike/s by the Fed by year end, some pressure might have been taken off.

As we mentioned yesterday, the RBA seems likely to attempt to signal further potential easing down the line, with the most likely scenario being a dovish hold on rates, potentially implying that knee-jerk weakness may be seen as a buying opportunity by Aussie bulls, as a combination of a higher yield, potential limited scope to cut rates and solid growth might be enough to keep the Aussie bid in early September until further rises in Fed bets.

Interestingly, the Aussie gained the most in a month heading into the event, higher alongside 10-year yields, potentially implying that the market has started to play out the above scenario by pre-positioning.

Taking this into account might help to explain the currency’s overall limited response to the news.

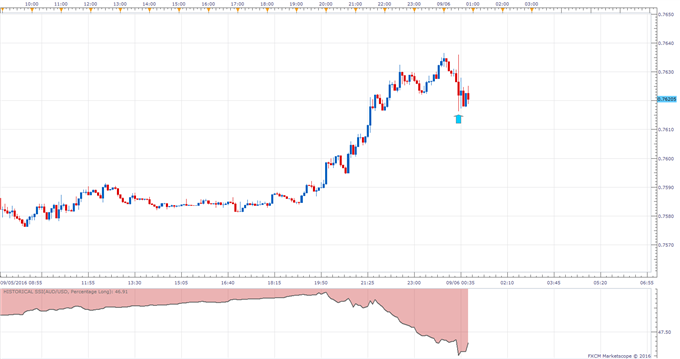

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing that about 46.9% of traders are long the AUD/USD at the time of writing after flipping short at the start of this week’s trading, offering a long bias on a contrarian basis.

You can find more info about the DailyFX SSI indicator here

AUD/USD 5-Minute Chart: September 06, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni