Talking Points:

- UK industrial production fell 0.4% y/y vs. 1.0% gain expected

- Manufacturing production down 1.7% y/y vs. 1.4% loss forecast

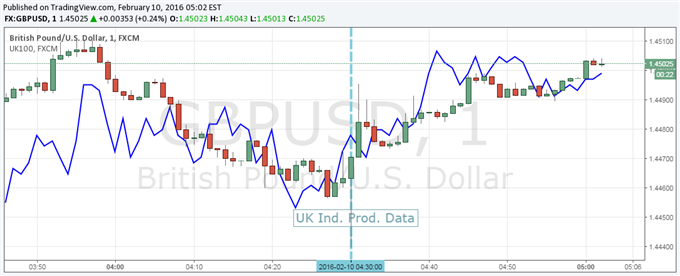

- Pound higher with stocks on demand for GBP-denominated assets

See how retail traders are positioning in the majors in your charts using the FXCM SSI snapshot.

The British Pound traded higher versus other major currencies (at the time this report was written) after today’s industrial production report came well below expectations, seemingly on demand for GBP-denominated assets. The report showed industrial production fell 1.1% in December, below the prior revised 0.8% drop and the expected -0.1% figure. The Year-on-year figure decreased 0.4%, which was well below the prior revised reading of +0.7%, and the expected reading of +1.0%. Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. The manufacturing output, which account for approximately 80% of overall industrial production, printed -0.2% in December, below an expected rise of 0.1%. The year-on-year figure fell 1.7%, below the expected -1.4% print.

Looking into the report, the Office for National Statistics said the largest contribution to the fall in the Industrial number came from the manufacturing figure, which was lower due to a decrease from the manufacture of wood, paper products and printing. The report came in line with last week’s Markit Manufacturing PMI, which saw a slight downtick suggesting industrial production is seeing downward pressures on prices. In their latest quarterly Inflation Report, the BoE said they see inflation at 1.2% in Q1 2017, down from a projection of 1.5% from November’s Inflation Report. The data today seems to be in line with the general weaker price pressure theme and have perhaps added further confirmation for the market’s perceived dovish BoE stance. Up until recently the BoE was considered likely to raise rates in 2016, but Overnight index swaps (OIS) is now showing a 60% probability for a rate cut in the central bank’s next meeting, and a 52% probability of a 25bps reduction 12 months from today.

It seems that the figures today may have reaffirmed market bets on a dovish BoE. The prospect of a more accompdative central bank may have helped push stocks higher, boosting demand for GBP-denominated assets. For it's part, Sterling may have shrugged off the negative implications of a more timid central bank considering the already-significant dovish shift in expectations in recent months. This could have allowed the currency to move higher alongside UK share prices.

GBP/USD 1 Minute Chart, UK100 Overlay

DailyFX Senior Currency StrategistKristian Kerr identified key resistance on the upside as last week’s high near 1.4670.