Talking Points:

- Third-quarter GDP exceeded forecasts in both quarterly and yearly figures

- Long AUD built up prior to the data and profit-taking lowered AUD/USD slightly

- RBA Governor Stevens hinted the RBA may wait for a Fed’s rate hike to play out first

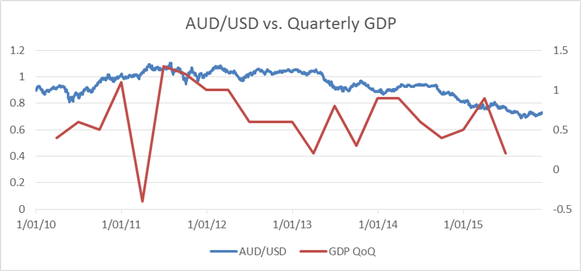

Third-quarter GDP data came out better than expected earlier today. The AUD/USD had steadily climbed up since yesterday in anticipation of good figures. The pair generally takes cue from GDP number, and this time the market was not disappointed.

AUD/USD immediately lowered after data release, likely due to profit-taking of these built up long positions. An intraday support level emerged at 0.7311, followed by 0.7303. Should prices descend below this area, today’s low and a firm support level comes in at 0.7277.

15-minute chart - Created Using FXCM Marketscope

Simultaneous to data release, Governor Glenn Stevens of the Reserve Bank of Australia was delivering upbeat messages at an Australia-Israel Chamber of Commerce event. He remarked that third-quarter GDP is a tad above the numbers the RBA had embodied, and that economic outlook was still for moderate growth.

While avoided comment on Australia’s interest rate, the Governor reiterated his view that global interest rates are already very low and countries need to focus on other measures to lift growth rather than relying on central banks. He highlighted that the broader economic picture rather than rates would determine capital expenditure.

With this viewpoint and confidence in the economy, Stevens seems to hint that the RBA may wait for global macro events (namely the Fed’s rate hike) to play out first before considering further actions. A U.S. rate rise and ensuing USD strength would inevitably drag down the AUD – in line with the RBA’s criteria in order to boost growth.

--- Written by Nathalie Huynh, Currency Strategist for DailyFX.com

Contact and follow Nathalie on Twitter: @nathuynh