Talking Points:

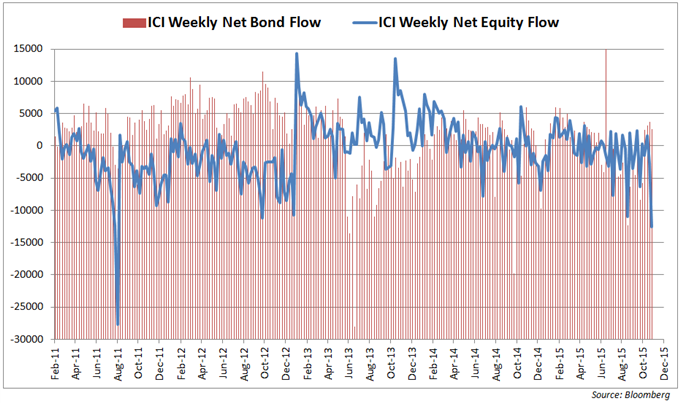

- Investors pulled more than $12.5 billion out of stock funds, most since August 2011

- Total bond flows hover around 5-month highs as Fed rate hike expectations climb

Follow comments from top officials as it is released with the real-time news feed !

Data reported by the Investment Company Institute (ICI) showed that investors pulled more than 12.5 billion dollars out of US-based stock mutual funds last week. This is the largest outflow since August 2011. At the same time, total bond flows were net-positive for a fourth consecutive week to hover near 5-month highs.

The outflow of money from stocks and into bonds may reflect speculation that the Federal Reserve will raise rates in December. Investors may be worried about the impact of tightening on earnings prospects at a time when sluggish performance in the Eurozone and deceleration in China are marking for an overall slowdown in global growth.

The tone of October’s FOMC policy statement and subsequent commentary from Fed officials has left the door conspicuously open to rate hike in December. Last week, an impressively strong set of US payrolls figures bolstered “liftoff” chances in the minds of investors. Fed funds futures now imply a 67.8 percent priced-in probability for a 25bps rate hike next month.