Talking Points:

- US economy added +271K jobs in October, +87K above the forecast.

- Unemployment rate drops as wages accelerate to fastest pace in post-GFC world.

- EUR/USD trades as low as $1.0707 after the report.

Mark your calendar for December 16: markets are aggressively pricing in the first Federal Reserve rate hike for next month after today’s exceptionally strong October US Nonfarm Payrolls report. The US Dollar is soaring across the board this morning after the October jobs figure blew past expectations, reaffirming the belief that the US economy is approaching the event horizon of the end of ZIRP. Underscoring the strong headline jobs figures – and perhaps the icing on the cake for the Fed – was the growth in wages, which reached the fastest pace since the financial crisis of 2008/2009.

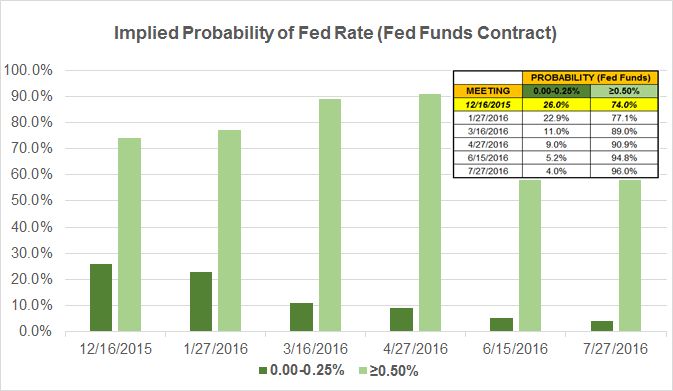

Ahead of the data, Fed funds futures contracts were giving an implied probability of 56% for a Fed rate hike in December; after the data, market measures had jumped to suggest that there was a 74% chance of a Fed rate hike next month. The chart below highlights how aggressively markets are anticipating the Fed to move on rates:

Here are the data that’s sent the US Dollar to fresh daily, weekly, and yearly highs:

- USD Change in Nonfarm Payrolls (OCT): +271K versus +184K expected, from +137K (revised lower from +142K).

- USD Unemployment Rate (OCT): 5.0% as expected from 5.1%.

- USD Average Hourly Earnings (OCT): +2.5% versus +2.3% expected, from +2.2% (y/y).

- USD Labor Force Participation (OCT): 62.4% unch as expected.

See the DailyFX economic calendar for Friday, November 6, 2015

EURUSD 1-minute Chart: November 6, 2015 Intraday

After the data releases, the US Dollar saw precipitous gains across the board, and has yet to relent. EUR/USD initially sunk from $1.0864 to as low as $1.0707, and was last trading at $1.0735. Meanwhile, USD/JPY jumped to as high as ¥123.04 from ¥121.92, and was trading at ¥122.72 at the time this report was written.

Read more: Trade Setups in EUR/USD, USD/JPY, USD-pairs for October NFPs

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form