Want to trade with proprietary strategies developed by FXCM? Find out how here.

Talking Points:

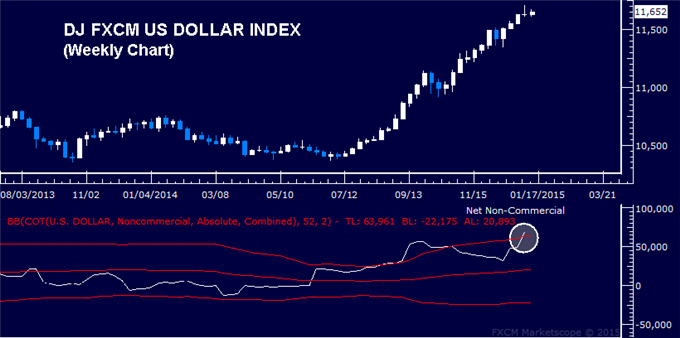

- US Dollar Outperformed Against the Major Currencies in 2014

- COT Data Suggests US Dollar Pullback May Be on Tap Ahead

- Put Positioning Data on Your Charts with the FXCM COT App

The US Dollar rose against all major currencies in 2014. Priced-in expectations show that the market anticipates the Federal Reserve will increase rates by at least 50 basis points over the next 12 months. A Fed move to hike rates before other major central banks has been pushing the US unit higher against its top counterparts. However, the greenback’s rally might be on the verge of a setback.

The CFTC’s latest Commitment of Traders report (which can be added to your charts) shows speculative traders’ net-long positioning hit a record high, extending over 2 standard deviations away from its 52-week average. This hints benchmark currency might be overbought and vulnerable to a corrective decline before the larger uptrend reasserts itself. Technical positioning likewise warns that a reversal may be in the cards.

Prepared by Shawn Jagpal, Created Using FXCM Marketscope