US DOLLAR OUTLOOK: USD PRICE ACTION GYRATES LOWER AS FED CHAIR POWELL SIGNALS ASSET PURCHASES TO CONTINUE AT CURRENT PACE

- US Dollar went on a roller coaster ride during Wednesday’s trading session as volatility spiked

- USD price action edged lower after PMIs then ripped and dipped following the FOMC decision

- The DXY Index could resume its grueling decline with US Dollar weakness looking set to persist

It was another rough trading session for US Dollar bulls who lacked impetus to sustain a bid once again. The broad-based DXY Index encountered another wave of selling pressure early Wednesday as EUR/USD price action gained on the latest PMI data and the Pound-Dollar extended its rally on the back of Brexit deal speculation. US Dollar weakness was offset slightly owing to a rebound by USD/CAD with the Loonie declining across the board in response to yesterday’s jawboning from BoC Governor Macklem. The US Dollar recovered more broadly into afternoon trade as the scheduled Fed announcement neared.

USD price action strengthened and climbed into positive territory immediately after the FOMC statement crossed market wires, which seemed attributable to a steepening US Treasury yield curve. This was likely sparked by central bank officials penciling in more optimistic economic projections. The bid beneath the US Dollar was short-lived, however, as Federal Reserve Chair Jerome Powell underscored that the central bank intends to continue its current pace of asset purchases at $120-billion per month.

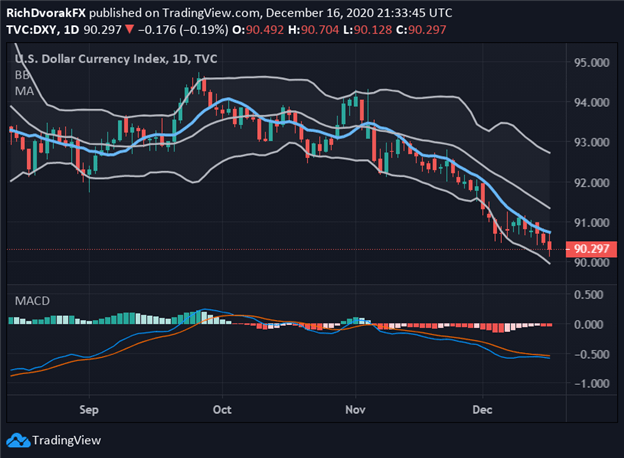

DXY - US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (13 AUG TO 16 DEC 2020)

Chart by @RichDvorakFX created using TradingView

Commentary from Fed Chair Powell, like how the FOMC intends to maintain its QE program until ‘substantial’ progress on mandated goals is made, or doubling down on dovish language with remarks that ‘no one should doubt Fed commitment to aiding the economy and utilizing monetary policy tools for as long as it takes’ appeared to signal a keenness for running markets hot and keeping them flush with liquidity. This seemed to have helped reinvigorate a risk-on tilt across major stock indices and introduced fresh headwinds to the safe-haven US Dollar.

The Federal Reserve also opted to extend its FX swap lines, which could facilitate lingering US Dollar weakness. Shifting gears to a technical perspective, the DXY Index faced another rejection at its 9-day simple moving average. This suggests that US Dollar bears are still in the driver seat. Likewise, the MACD indicator shows that bearish momentum has re-accelerated over the last two trading sessions. These developments, not to mention progress made by congress on fiscal stimulus and omnibus spending packages, stand to keep the door open for a continuation of US Dollar selling pressure.

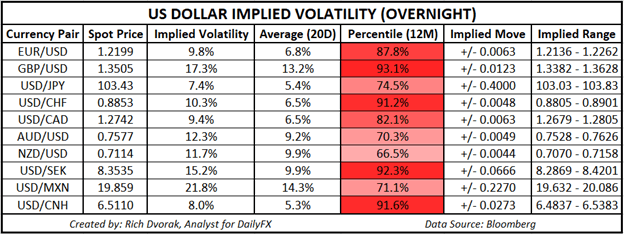

USD PRICE OUTLOOK - US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Learn More - What is Implied Volatility & Why Should Traders Care?

That all said, catalysts with potential of igniting a reversal higher by USD price action still lurk on the horizon. A material deterioration in risk appetite as near-term covid concerns and mounting lockdowns clash with broader vaccine optimism, in addition to a breakdown in either Brexit or US fiscal negotiations, stand out as most prominent. If these threats materialize, there could be a sharp spike in the S&P 500-derived VIX Index, which might correspond with a stronger US Dollar in turn given their generally strong positive relationship.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight