US DOLLAR OUTLOOK: USD PRICE ACTION RIPE FOR VOLATILITY AMID FOMC COMMENTARY, STIMULUS NEGOTIATIONS, & UPDATES ON TRUMP’S HEALTH

- The US Dollar drops to start the week owing to a recovery in market sentiment

- DXY Index has potential to rebound higher if US Dollar bulls can defend the 50-DMA

- USD looks primed for more volatility with Trump, FOMC officials, and stimulus talks in focus

The condition of president trump improving over the weekend has likely caused a downshift in coronavirus concerns, which appears to be boosting market sentiment in turn. This has corresponded with a boost to major stock indices and deeper pullback by the anti-risk US Dollar. The broad-based US Dollar Index has declined five out of the last six trading sessions and now trades more than 1% below its September swing high. Better-than-expected US Services PMI data released shortly after the Wall Street open this morning has helped USD price action strengthen off intraday lows, however.

DXY - US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (28 MAY TO 05 OCTOBER 2020)

Chart created by @RichDvorakFX with TradingView

A DXY chart shows that US Dollar selling pressure has steered the safe-haven currency toward resistance-turned-support underscored by the 93.50-price level. This potential area of buoyancy is roughly highlighted by its 50-day moving average. A breakdown below this level, however, could invalidate the bullish inverse head and shoulder bottoming pattern developed over the last two months.

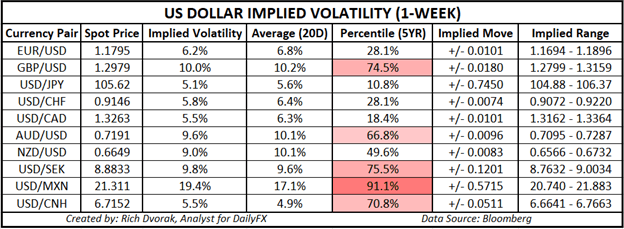

USD PRICE OUTLOOK - US DOLLAR IMPLIED VOLATILITY TRADING RANGES (1-WEEK)

That said, there is potential for USD price action to fluctuate within a trading range as resurgent market volatility lingers. The direction of the US Dollar hinges largely on trader sentiment surrounding the prognosis of President Trump as he attempts to recover from catching the coronavirus. Though recent updates from POTUS suggests he remains in overall good health, there may still be potential for a worsening of symptoms as Trump battles the coronavirus. Not to mention, fiscal stimulus negotiations could also weigh materially on where USD price action heads next.

Politicians have struggled to reach another coronavirus aid bill, but markets have turned more optimistic recently as Treasury Secretary Mnuchin and House Speaker Pelosi attempt to make progress toward reaching a deal. Furthermore, a slew of speeches from Federal Reserve officials scheduled this week - detailed on the DailyFX Economic Calendar - could fuel US Dollar volatility as well. Options-implied trading ranges are calculated using 1-standard deviation (i.e. 68% statistical probability price action is contained within the implied trading range over the specified time frame).

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight