US DOLLAR FORECAST: USD/JPY, EUR/USD, GBP/USD, AUD/USD PRICE OUTLOOK

- The US Dollar Index (DXY) sets its sights back on the 100.00 handle after USD price action rips nearly 5% higher over the last six trading sessions

- Spot USD/JPY prices pop as EUR/USD and GBP/USD drop despite increasingly accommodative monetary policy actions from the FOMC

- AUD/USD extends its rout with spot prices bleeding deeper into the lows recorded during the global financial crisis over a decade ago

USD price action, gauged by the US Dollar Index, is on a tear higher after its sharp slide beginning late last month. The broad selloff in the US Dollar was sparked by rekindled recession risk, largely due to economic fallout from the coronavirus outbreak, which prompted the Federal Reserve to slash benchmark interest rates to zero and launch a $700bn quantitative easing program.

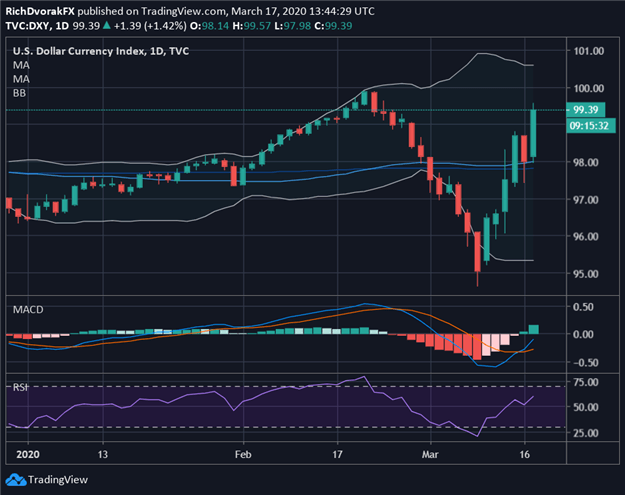

US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (DECEMBER 30, 2019 T0 MARCH 17, 2020)

Chart created by @RichDvorakFX with TradingView

Despite recent dovish action by the Fed, however, the US Dollar has climbed nearly 5% off its lowest level since September 2018 over the last few trading sessions – a remarkable move as FX volatility returns with vengeance.

The DXY Index, a basket of major currency pairs that tracks general performance of the US Dollar, is now trading back near three-year highs with technical resistance residing near the 100.00 handle and February 20 intraday swing high.

Demand for safe-haven currencies, such as the US Dollar, has strengthened as the coronavirus pandemic deepens. The latest stretch of upside in USD price action is likely being exacerbated by funding market distress as well, which could keep propelling the US Dollar higher.

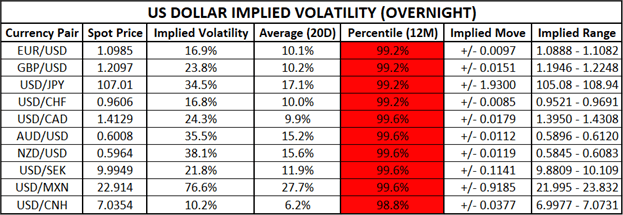

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY & TRADING RANGES (OVERNIGHT)

Currency volatility expected in the USD and key peers continues to edge higher as market activity accelerates. US Dollar overnight implied volatility readings remain in the top 99th percentile of readings taken over the last 12-months, which underscores the above-average degree of uncertainty hanging over the FX market and warrants exercise of prudent risk management techniques and trading strategies. Options-implied trading ranges are calculated using 1-standard deviation (i.e. 68% statistical probability price action is contained within the implied trading range over the specified time frame).

Keep Reading: US Dollar Whipsaws on Fed Virus Response – USD Trade Levels

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight