USD Forecast: US Dollar Drives Lower as Fed Rate Cut Bets Rise Ahead of Consumer Confidence Data

- USD price action continued to pivot lower from three-year highs as traders ramp up dovish expectations for the Federal Reserve amid mounting coronavirus concerns

- The US Dollar faces further downside potential as market participants reaccelerate future Fed interest rate cut expectations in light of an inverted yield curve and rising recession risk

- Consumer confidence data due for release during Tuesday’s trading session could weigh materially on Fed rate cut bets and thus the US Dollar

A wave of risk-aversion plagued markets on Monday as fear of the novel coronavirus outbreak and its impact on economic growth festered over the weekend.

While worsening market sentiment frequently bolsters USD price action, which is largely due to the Greenback’s posturing as the premier safe-haven currency, the US Dollar nevertheless extended Friday’s plunge.

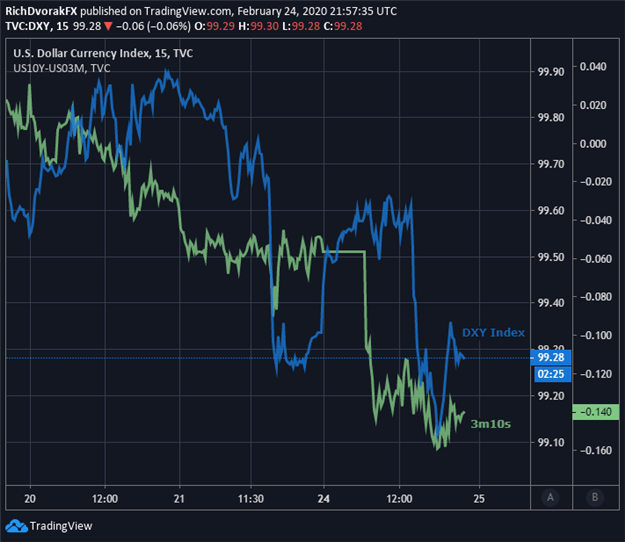

US DOLLAR HAMMERED AS TREASURY YIELD CURVE INVERSION DEEPENS

Another bulge in Fed interest rate cut expectations and deeper Treasury yield curve inversion likely underpin recent weakness in the US Dollar Index.

Measured via the DXY Index, the broader US Dollar is now trading more than 0.5% below the February 20 intraday swing high of 99.91 – the strongest reading in nearly three years.

In addition to the latest coronavirus headlines, upcoming consumer confidence data slated for release Tuesday, February 25 at 15:00 GMT has potential to weigh considerably on USD price action as well.

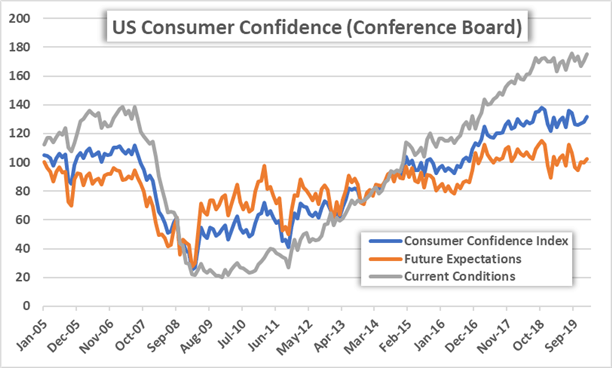

US CONSUMER CONFIDENCE DATA MAY REFLECT MOUNTING CORONAVIRUS CONCERNS

The headline US consumer confidence figure for February 2020 is expected to cross the wires with a reading of 132.1 and compares to the prior period’s reading of 131.6.

It is noteworthy, however, that consumer confidence could be understated due to the time-lag of the report; the preliminary survey data release only includes responses received by the 18th of the month.

As such, the upcoming consumer confidence report will largely overlook the abrupt return of coronavirus concerns and corresponding plunge in stocks over the last few days.

This could place greater credence on changes in the underlying consumer confidence index components – future expectations and current conditions.

Nevertheless, recent US Dollar selling pressure might be exacerbated by a worse-than-expected consumer confidence report.

This is seeing that deteriorating consumer confidence could encourage the Federal Reserve to discard its neutral monetary policy stance conveyed out of the January Fed meeting.

In lieu of keeping rates on hold this year, the Fed may capitulate to FOMC interest rate cut expectations currently being priced in – likely as insurance against downside risks stemming from the coronavirus outbreak – if consumer confidence shows signs of material degradation.

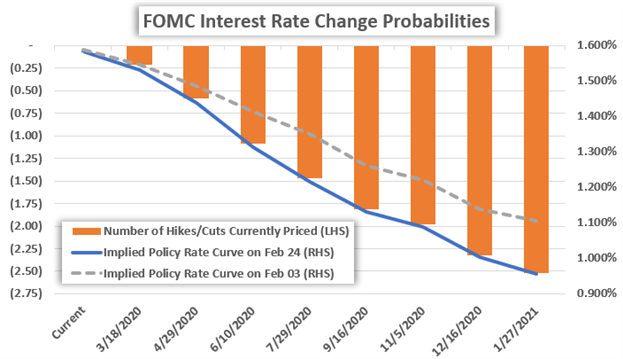

CHART OF FED INTEREST RATE CUT PROBABILITIES (FUTURES-IMPLIED)

Since the beginning of February,interest rate traders have priced in an additional 15-basis points of cuts from the Fed by next year according to the latest overnight swaps data. A full quarter-point interest rate cut from the Fed is now expected by June 2020.

Lofty Fed rate cut bets now being priced in to combat rekindled recession odds and an inverted yield curve have potential of unwinding, however, and could send the US Dollar quickly snapping back higher. This development would likely come in response to robust consumer confidence data or improving risk appetite.

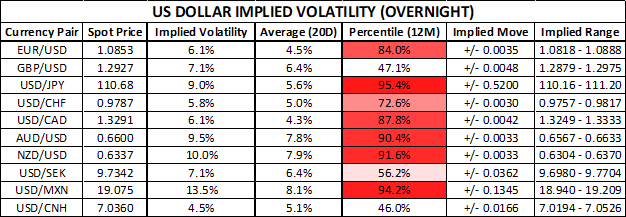

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY & TRADING LEVELS

Learn More: US Dollar Volatility Report – USD Price Analysis & Trading Levels

Judging by the latest overnight implied volatility readings across key US Dollar crosses, currency volatility looks set to spike over the next 24-hours. This underscores the importance of keeping close tabs on high-impact economic indicators such as the monthly release of consumer confidence data.

USD/JPY overnight implied volatility of 9.0% ranks in the top 95th percentile of measurements taken over the last 12-months and compares to its 20-day average reading of 5.6%. NZD/USD is expected to be the most active US Dollar currency pair out of the G7 majors with an overnight implied volatility reading of 10.0%.

| Change in | Longs | Shorts | OI |

| Daily | -9% | -4% | -5% |

| Weekly | -18% | -3% | -6% |

Additional event risk faced by major currency pairs over the next week is detailed on the DailyFX Economic Calendar.Options-implied trading ranges are calculated using 1-standard deviation (i.e. 68% statistical probability price action is contained within the implied trading range over the specified time frame).

Keep Reading: USD/MXN Price Analysis – US Dollar Spikes to 11 Week High vs Peso

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight