USD PRICE ANALYSIS – US DOLLAR CHARTS & TRADING LEVELS TO WATCH THIS WEEK: GBP/USD, USD/JPY, AUD/USD

- Currency volatility expected in the US Dollar and other major currency pairs spiked ahead of this week’s barrage of high-impact economic data releases and scheduled event risk

- AUD/USD is anticipated to be the most active US Dollar forex pair in light of the RBA interest rate decision on deck as traders wrestle with coronavirus fears

- One-week implied volatility in spot USD/JPY jumped to its highest reading since September 2019 ahead of closely watched ISM PMI reports and nonfarm payrolls data due

USD price action is anticipated to rise from extreme lows this week according to the recent spike in US Dollar implied volatility readings. This likely comes as little surprise, however, considering the forex economic calendar is littered with fundamental event risk throughout the trading week.

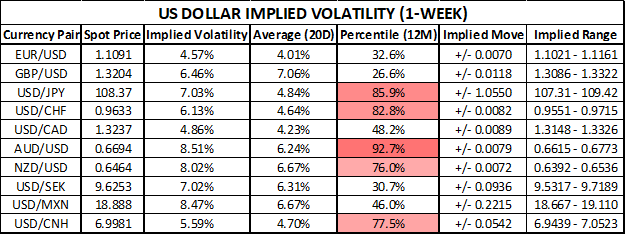

CHART OF US DOLLAR IMPLIED VOLATILITY (1-WEEK)

The US Dollar is already getting a boost to start the week on balance with the DXY Index surging 0.5% back toward the 98.00 handle. Majority of today’s upside in the US Dollar Index can be attributed to a plunge in the GBP/USD prices ahead of preliminary EU-UK trade talks.

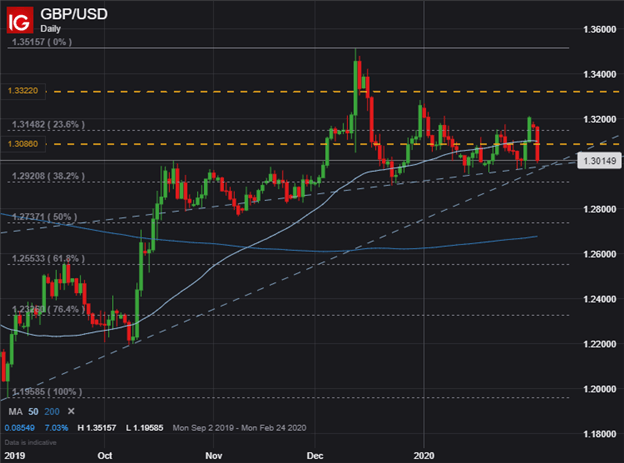

GBP/USD PRICE CHART: DAILY TIME FRAME (SEPTEMBER 2019 TO FEBRUARY 2020)

The Pound Sterling is already off by about 160-pips against its US Dollar counterpart so this week, which has sent spot GBP/USD to test the 1.3000 handle and now trades below its one-week implied trading range calculated from Friday’s closing price.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 12% | 5% |

| Weekly | 7% | -2% | 4% |

Seeing that implied trading ranges are calculated to contain price action with a 68% statistical probability, spot GBP/USD may soon rebound back toward its 50-day simple moving average as the US Dollar gives back some of its recent gains.

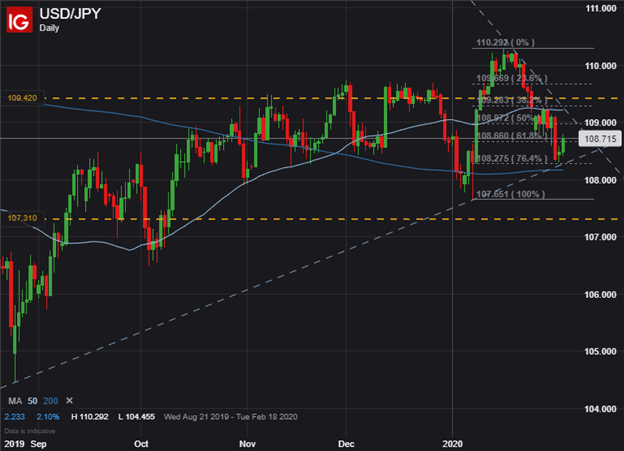

USD/JPY PRICE CHART: DAILY TIME FRAME (AUGUST 2019 TO FEBRUARY 2020)

USD/JPY seems to be finding technical support so far this week as spot prices bounce off its bullish trendline connecting the August 25, 2019 and January 07, 2020 intraday lows. The 76.4% Fibonacci retracement of the year-to-date trading range etched out by USD/JPY also seems to have sent spot prices ricocheting higher.

Moreover, spot USD/JPY price action could continue marching higher as the US Dollar climbs on the back of a recovery in broader market sentiment as coronavirus fears recede. A strong ISM Manufacturing PMI report released earlier this morning is also likely helping boost the US Dollar as future FOMC interest rate cut expectations unwind modestly.

The US Dollar to Japanese Yen exchange rate tends to fluctuate considerably to changes in expected interest rate differentials. On that note, closely watched ISM Services/Non-Manufacturing PMI report and NFP data due for release Wednesday, February 05 at 15:00 GMT and Friday, February 07 at 13:30 GMT respectively could spark outsized moves in spot USD/JPY.

AUD/USD PRICE CHART: DAILY TIME FRAME (SEPTEMBER 2019 TO FEBRUARY 2020)

AUD/USD recorded a staggering slide last month with spot prices sinking about 4.5% since the Aussie-Dollar eclipsed the 0.7000 handle. The impact of the novel coronavirus outbreak in Wuhan, China is likely weighing negatively on spot AUD/USD prices considering China is Australia’s primary export market. At the same time, market expectations have ramped up for further monetary policy accommodation from Reserve Bank of Australia (RBA) this year.

According to overnight swaps pricing, rate raters are currently pricing in roughly 42-basis points of interest rate cuts by the December 2020 RBA meeting, which is up from 20-bps of cuts priced in at the start of the year. The RBA is on deck to release its latest interest rate decision tomorrow, February 4 at 3:30 GMT and could warrant a considerable reaction in spot AUD/USD.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight