Canadian Dollar Talking Points

USD/CAD continues to pullback from a fresh monthly high (1.2938) following the kneejerk reaction to the Federal Reserve interest rate decision, and the exchange rate may face a larger correction over the coming days amid the failed attempt to test the yearly high (1.2949).

USD/CAD Susceptible to Larger Pullback on Failed Test of Yearly High

USD/CAD snaps the series of higher highs and lows carried over from the previous week as it tracks the broad range from the second half of the year, and the exchange rate may continue to give back the advance from the monthly low (1.2667) as the adjustment in the Fed’s forward guidance does little to fuel bets for an imminent rate hike.

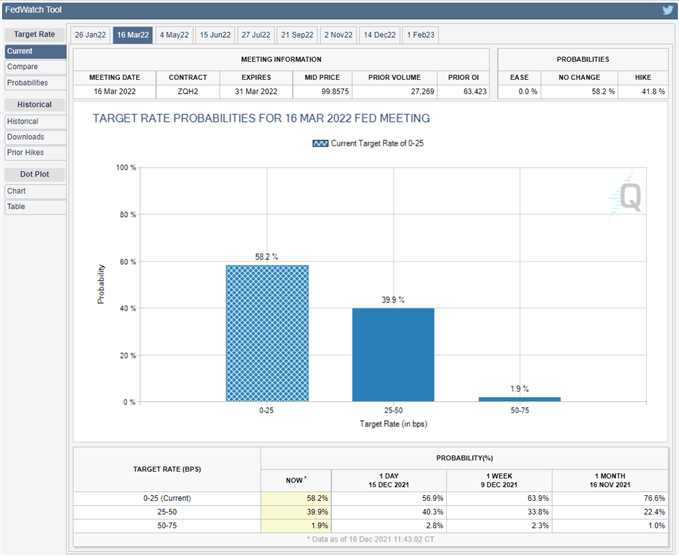

Source: CME

According to the CME FedWatch Tool, market participants see a greater than 50% probability that the Federal Open Market Committee (FOMC) will keep the benchmark interest rate at the record low at the next quarterly meeting in March 2022.

The reading based on Fed fund futures suggests the upward revision in the interest rate dot plot has caught up with market expectations as Chairman Jerome Powell and Co. project three rate-hikes for 2022, and it remains to be seen if the FOMC will continue to alter the forward guidance in the year ahead as the central bank acknowledges that “price increases have now spread to a broader range of goods and services.”

In turn, USD/CAD may face a larger correction ahead the next Fed rate decision on January 26, 2022 as the advance from the monthly low (1.2667) fails to push the RSI into overbought territory, and the recent flip in retail sentiment may carry into the end of the year as the exchange rate trades within broad range in the second half of 2021.

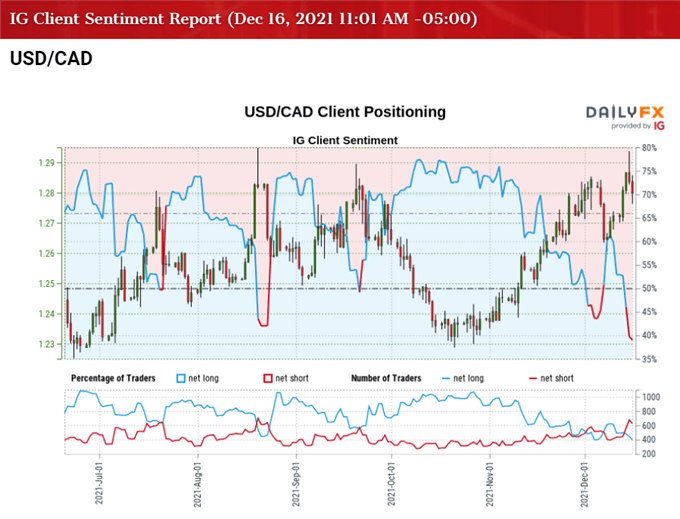

The IG Client Sentiment report shows 46.25% of traders are currently net-long USD/CAD, with the ratio of traders short to long standing at 1.16 to 1.

The number of traders net-long is 2.56% lower than yesterday and 33.72% lower from last week, while the number of traders net-short is 20.78% lower than yesterday and 41.33% higher from last week. The decline in net-long position comes as USD/CAD fails to test the yearly high (1.2949), while the jump in net-short interest has fueled the flip in retail sentiment as 64.72% of traders were net-long the pair last week.

With that said, USD/CAD may face larger correction over the coming days as it snaps the series of higher highs and lows carried over from last week, and the Relative Strength Index (RSI) may continue to show the bullish momentum abating as it reveres ahead of overbought territory.

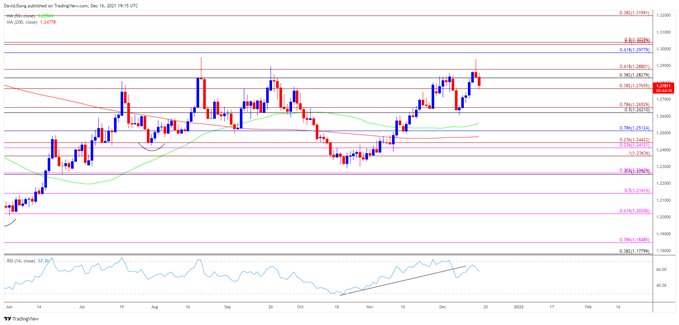

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, USD/CAD cleared the January high (1.2881) in August as an inverse head-and-shoulders formation took shape, but the exchange rate failed to defend the July low (1.2303) in October as the Relative Strength Index (RSI) dipped below 30.

- As a result, USD/CAD may continue to trade within a broad range as the recovery from the October low (1.2288) failed to produce a test of the yearly high (1.2949), with a similar scenario taking shape in December as a RSI sell signal emerged during the same period.

- The RSI appears to be diverging with price as it failed to push above 70 even as USD/CAD cleared the opening range for December, and the bullish momentum may continue to abate as the oscillator reverses course ahead of overbought territory.

- Lack of momentum to hold above the Fibonacci overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) has pushed USD/CAD back towards 1.2770 (38.2% expansion) area, with a further decline in the exchange rate bringing the 1.2620 (50% retracement) to 1.2650 (78.6% expansion) region on the radar.

- A break of the monthly low (1.2606) may push USD/CAD towards the 50-Day SMA (1.2535), with the next area of interest coming in around 1.2510 (78.6% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong