Japanese Yen Talking Points

USD/JPY attempts to halt a five day decline in an effort to defend the November low (112.53), and fresh data prints coming out of the US may shore up the exchange rate as the Non-Farm Payrolls (NFP) report is anticipated to show a further improvement in the labor market.

USD/JPY Rate Attempts to Defend November Low Ahead of US NFP Report

A near-term correction appears to be unfolding in USD/JPY after it cleared the March 2017 high (115.50), with the decline from the yearly high (115.52) largely tracking the weakness in longer-dated US Treasury yields as the Omicron variant of COVID-19 clouds the outlook for the global economy.

Nevertheless, the NFP report may generate a bullish reaction in USD/JPY as the update is expected to show the US economy adding 550K jobs in November while the Unemployment Rate is seen narrowing to 4.5% from 4.6% during the same period.

Evidence of a stronger labor market may put pressure on the Federal Reserve to adjust its exit strategy as Chairman Jerome Powell pledges to “use our tools to make sure that higher inflation does not become entrenched,” and it remains to be seen if the central bank will forecast a steeper path for the Fed funds rate as officials are slated to update the Summary of Economic Projections (SEP) at their next interest rate decision on December 15.

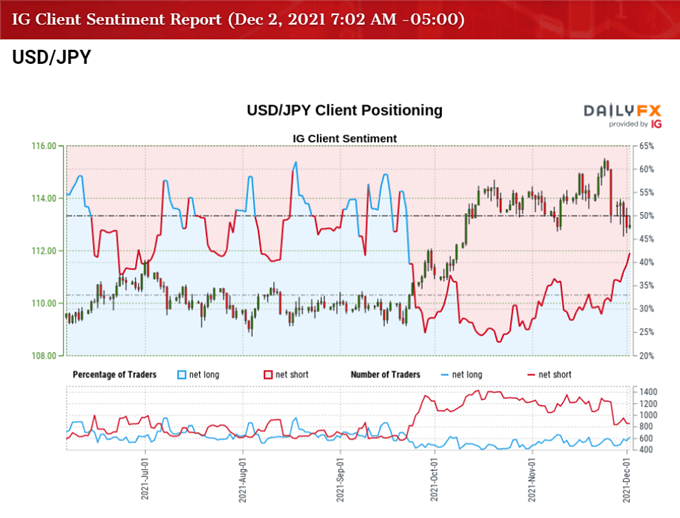

Until then, the monthly opening range is in focus for USD/JPY as it attempts to defend the November low (112.53), but a larger pullback in the exchange rate may continue to alleviate the tilt in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment report shows 40.57% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 1.46 to 1.

The number of traders net-long is 8.33% higher than yesterday and 2.29% lower from last week, while the number of traders net-short is 1.13% lower than yesterday and 30.37% lower from last week. The decline in net-long position comes as USD/JPY trades near the November low (112.53), while the sharp drop in net-short interest has helped to alleviate the crowding behavior as 31.65% of traders were net-long the pair last week.

With that said, USD/JPY may exhibit a bullish trend throughout the remainder of the year amid the diverging paths between the Federal Open Market Committee (FOMC) and Bank of Japan (BoJ), and the decline from the yearly high (115.52) may turn out to be a near-term correction in the exchange rate as it appears to be defending the November low (112.53).

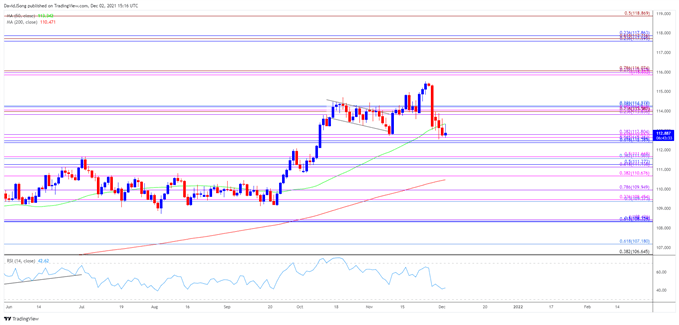

USD/JPY Rate Daily Chart

Source: Trading View

- The broader outlook for USD/JPY remains constructive as it trades to fresh yearly highs throughout the second half of 2021, with the 200-Day SMA (110.47) indicating a similar dynamic as it retains the positive slope from earlier this year.

- The Relative Strength Index (RSI) showed a similar dynamic as it pushed into overbought territory for the first time since the first quarter of 2021, but a textbook sell signal materialized in October as the oscillator fell back from overbought territory to slip below 70.

- Nevertheless, USD/JPY cleared the November 2017 high (114.74) as it broke out of a bull flag formation, with the exchange rate taking out the March 2017 high (115.50) in November even as the RSI failed to push into overbought territory.

- In turn, the decline from the yearly high (115.52) may turn out to be a correction in the broader trend as USD/JPY appears to be defending the November low (112.53), and lack of momentum to break/close below the 112.40 (61.8% retracement) to 112.40 (38.2% expansion) region may push the exchange rate back towards the Fibonacci overlap around 113.80 (23.6% expansion) to 114.30 (23.6% retracement).

- A break above the November high (115.52) opens up the 115.90 (100% expansion) to 116.10 (78.6% expansion) area, with the next region of interest coming in around 117.60 (23.6% retracement) to 117.90 (23.6% retracement).

- However, failure to defend the November low (112.53) may push USD/JPY towards the 111.10 (61.8% expansion) to 111.70 (50% expansion) region, with the next area of interest coming in around 110.70 (38.2% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong