Canadian Dollar Talking Points

USD/CAD clears the January low (1.2589) even as longer-dated US Treasury yields hold above pre-pandemic levels, and the commodity bloc currency may continue to outperform its US counterpart as the recent weakness in the Canadian Dollar appears to have been a correction in the broader trend rather than a change in market behavior.

USD/CAD Rate Remains Vulnerable Following Break Below January Low

USD/CAD trades to a fresh 2021 low (1.2581) following the string of failed attempts to climb back above the 50-Day SMA (1.2734), and key market themes may keep the exchange rate under pressure as the Federal Reserve remains on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.”

It remains to be seen if the Congressional testimony from Fed Chairman Jerome Powell will influence the near-term outlook for USD/CAD as the Federal Open Market Committee (FOMC) relies on its non-standard tools to achieve its policy targets, and the prepared remarks may largely mimic the language found in the January meeting minutes as “all participants supported maintaining the Committee's current settings and outcome-based guidance for the federal funds rate and the pace of asset purchase.”

More of the same from Chairman Powell may produce headwinds for the US Dollar as the FOMC appears to be in no rush to scale back its emergency measures, and it seems as though the Bank of Canada (BoC) will follow a similar approach as the central bank insist that “the Bank will continue its QE (quantitative easing) program until the recovery is well underway.”

It seems as though the BoC will retain the current course for monetary policy as “growth in the first quarter of 2021 is now expected to be negative,” but fresh remarks from Governor Tiff Macklem may indicate a looming shift in the forward guidance as “the outlook for Canada is now stronger and more secure than in the October projection, thanks to earlier-than-expected availability of vaccines and significant ongoing policy stimulus.”

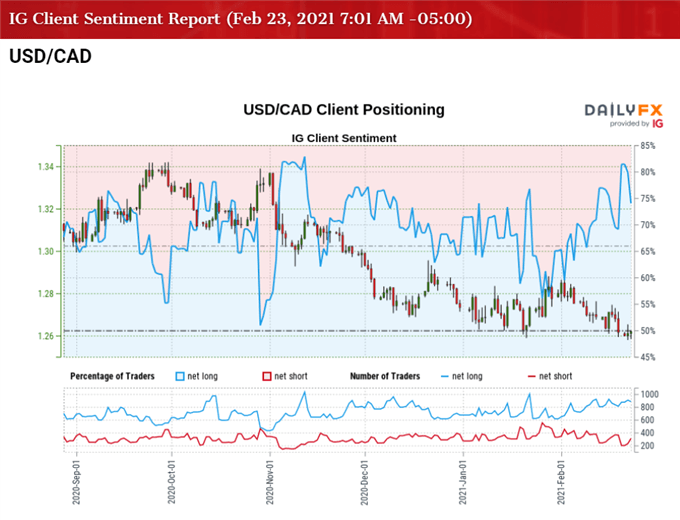

In turn, the BoC may continue to acknowledge that “a broad-based decline in the US exchange rate combined with stronger commodity prices have led to a further appreciation of the Canadian dollar” at its next meeting on March 10, but the tilt in retail sentiment looks poised to persist as traders have been net-long USD/CAD since May 2020.

The IG Client Sentiment report shows 75.24% of traders are net-long with the ratio of traders long to short at 3.04 to 1.

The number of traders net-long is 0.21% lower than yesterday and 3.01% lower from last week, while the number of traders net-short is 0.65% lower than yesterday and 4.78% higher from last week. The rise in net-short interest comes as USD/CAD takes out the January low (1.2589), while the decline in net-long position has spurred a further tilt in retail sentiment as 64.98% of traders were net-long the pair during the previous week.

With that said, the recent rebound in USD/CAD appears to have been a correction in the broader trend rather than a change in market behavior as the exchange rate trades to a fresh 2021 low (1.2581), with the Relative Strength Index (RSI) indicating a similar dynamic as the oscillator snaps the upward trend from earlier this year.

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, USD/CAD cleared the January 2020 low (1.2957) following the US election, with the exchange rate trading to fresh yearly lows in November and December as the Relative Strength Index (RSI) established a downward trend during the same period.

- USD/CAD started off 2021 by taking out last year’s low (1.2688) even though the RSI broke out of the bearish formation, with lack of momentum to hold above the 1.2770 (38.2% expansion) region pushing the exchange rate briefly below the Fibonacci overlap around 1.2620 (50% retracement) to 1.2650 (78.6% expansion).

- However, USD/CAD broke out of the opening range for January following the string of failed attempt to close below the 1.2620 (50% retracement) to 1.2650 (78.6% expansion) region, with the RSI diverging with price as it established an upward trend.

- Nevertheless, the rebound from the January low (1.2589) appears to have been a correction in the broader trend rather than a change in USD/CAD behavior as the exchange rate trades to a fresh 2021 low (1.2581) following the string of failed attempts to climb back above the 50-Day SMA (1.2734).

- The close below the 1.2620 (50% retracement) to 1.2650 (78.6% expansion) zone brings the 1.2510 (78.6% retracement) area on the radar, with the next region of interest coming in 1.2440 (23.6% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong