New Zealand Dollar Talking Points

NZD/USDclears the opening range for December as the exchange rate extends the advance from the monthly low (0.7006), and the recent weakness in the exchange rate appears to have been an exhaustion in the bullish trend rather than a change in market behavior as the Relative Strength Index (RSI) pushes back into overbought territory.

NZD/USD Clears Monthly Opening Range to Push RSI Into Overbought Zone

NZD/USD consolidates after trading to a fresh yearly high (0.7120) as the US Dollar rebounds on the back of waning investor confidence, and swings in risk appetite may continue to sway the exchange rate as the Federal Reserve’s balance sheet approaches the record high seen in November.

It remains to be seen if the Federal Open Market Committee (FOMC) will take additional steps to support the US economy as the European Central Bank (ECB) expands the pandemic emergency purchase programme (PEPP) by EUR 500B ahead of 2021, but the ongoing response to the COVID-19 pandemic are likely to keep key market trends in place as monetary authorities rely on their non-standard measures to achieve their policy targets.

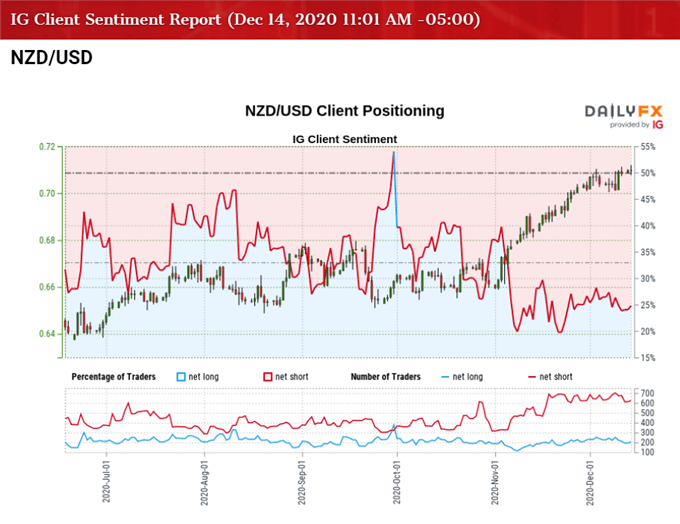

In turn, the US Dollar may continue to show an inverse relationship with investor confidence ahead of the Fed interest rate decision on December 16, and the crowding behavior in retail sentiment also looks poised to persist as the crowding behavior from earlier this year resurfaces.

The IG Client Sentiment report shows 29.34% of traders are net-long with the ratio of traders short to long at 2.41 to 1. The number of traders net-long is 32.47% higher than yesterday and 22.38% higher from last week, while the number of traders net-short is 0.98% higher than yesterday and 2.67% lower from last week.

The rise in net-long position comes as NZD/USD trades to a fresh yearly high (0.7120), while the decline in net-short interest has helped to alleviate the tilt in retail sentiment as only 25.44% of traders were net-long the pair during the previous week.

With that said, the recent weakness in NZD/USD appears to have been an exhaustion in the bullish trend rather than a change in market behavior as it clears the opening range for December, and the exchange rate may continue to trade to fresh yearly highs throughout the remainder of the month as the Relative Strength Index (RSI) pushes back into overbought territory.

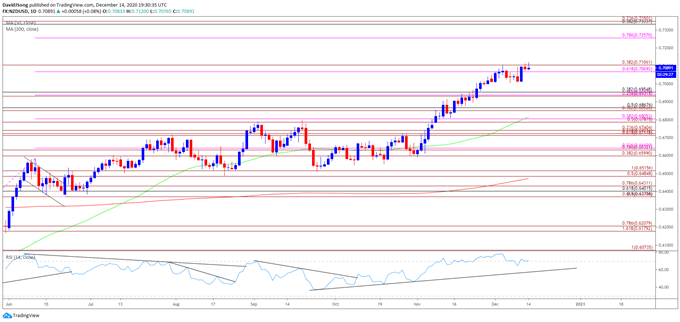

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, NZD/USD cleared the February high (0.6503) in June as the Relative Strength Index (RSI) broke above 70 for the first time in 2020, with the exchange rate taking out the January high (0.6733) in September following the close above the Fibonacci overlap around 0.6710 (61.8% expansion) to 0.6740 (23.6% expansion).

- However, lack of momentum to close above the 0.6790 (50% expansion) region pushed NZD/USD below the Fibonacci overlap around 0.6600 (38.2% expansion) to 0.6630 (78.6% expansion), with the RSI slipping to its lowest level since April during the same period.

- NZD/USD appeared to be on track to test the August low (0.6489) as the RSI established a downward trend in September, but the decline from the September high (0.6798)turned out to be an exhaustion in the bullish trend rather than a change in NZD/USD behavior as the 0.6490 (50% expansion) to 0.6520 (100% expansion) region provided support.

- The RSI highlighted a similar dynamic as it reverses course ahead of oversold territory to break out of the bearish formation from September, with the oscillator establishing an upward trend in October.

- Lack of momentum to test the August low (0.6489) pushed NZD/USD back above the 0.6600 (38.2% expansion) to 0.6630 (78.6% expansion) region, with the exchange rate clearing the September high (0.6798) in November, which pushed the RSI into overbought territory for the first time since June.

- NZD/USD also cleared the June 2018 high (0.7060) as it climbed to a fresh yearly highs in December, and the advance from the monthly low (0.7006) may gather pace as the RSI pushes back above 70.

- Still need a close above the Fibonacci overlap around 0.7070 (61.8% expansion) to 0.7110 (38.2% expansion) to open up the 0.7260 (78.6% expansion) region, with the next area of interest coming in around 0.7330 (38.2% retracement) to 0.7350 (23.6% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong