Australian Dollar Talking Points

AUD/USD consolidates after testing the monthly high (0.7340), but recent price action points to a further appreciation in the exchange rate as it carves a series of higher highs and lows.

AUD/USD Tests Monthly High as Bullish Price Pattern Takes Shape

Key market themes may keep AUD/USD afloat as the US Dollar broadly reflects an inverse relationship with investor confidence, and the correction from the yearly high (0.7414) appears to have been an exhaustion in the bullish trend rather than a change in behavior as the new measures taken by the Reserve Bank of Australia (RBA) does little to cap the exchange rate.

AUD/USD may continue to appreciate ahead of the RBA’s last meeting for 2020 even though the central bank pushes the official cash rate (OCR) to a fresh record low of 0.10% as Governor Philip Lowe and Co. look towards their non-standard tools to further support the Australian economy.

It seems as though the RBA will utilize its balance sheet rather than implementing a negative interest rate policy (NIRP) as the central bank plans to purchase “$100 billion of government bonds of maturities of around 5 to 10 years over the next six months,” and it remains to be seen if Governor Lowe and Co. will adjust its quantitative easing (QE) program in 2021 as the board reduces the target yield for the 3-year Australian Government bond to around 0.1 percent and insists that “any bonds purchased to support this target would be in addition to the $100 billion bond purchase program.”

Nevertheless, the limited duration surrounding the RBA’s QE program may ultimately act as a backstop for AUD/USD as the Federal Reserve’s balance sheet approaches the record high, and key market trends may carry into the end of the year as Chairman Jerome Powell and Co. vow to “to increase our holdings of Treasury securities and agency mortgage-backed securities at least at the current pace.”

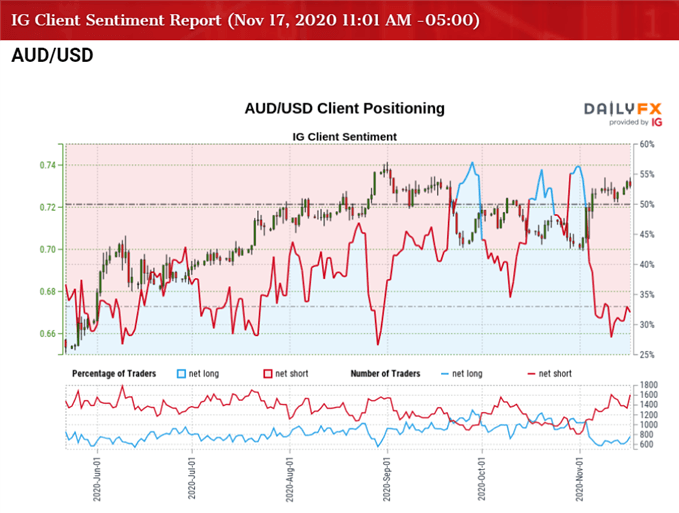

At the same time, the tilt in retail sentiment from earlier has resurfaced even though AUD/USD tests the monthly high (0.7340), with the IG Client Sentiment report showing 30.59% of traders net-long the pair as the ratio of traders short to long stands at 2.27 to 1.

The number of traders net-long AUD/USD is 3.98% lower than yesterday and 13.09% higher from last week, while the number of traders net-short is 7.66% higher than yesterday and 1.21% higher from last week. The rise in net-long position could be in reaction to the recent series of higher highs and lows in the exchange rate, while the increase in net-short interest indicates that the crowding behavior in AUD/USD is likely to persist even though the US Dollar broadly reflects an inverse relationship with investor confidence.

With that said, swings in risk appetite may sway AUD/USD ahead of the RBA meeting on December 1 as the central bank looks poised to retain the current policy, but recent price action points to a further appreciation in AUD/USD as the exchange rate carves a series of higher highs and lows.

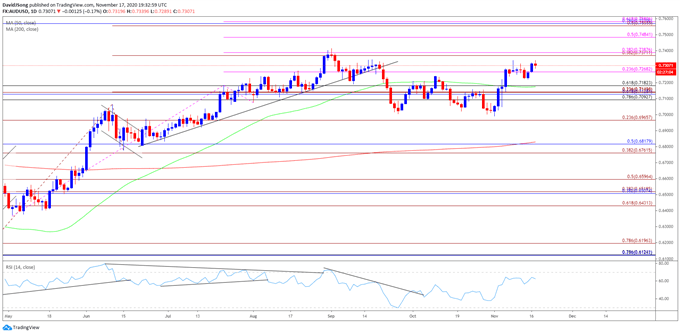

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the advance from the 2020 low (0.5506) gathered pace as AUD/USD broke out of the April range, with the exchange rate clearing the January high (0.7016) in June as the Relative Strength Index (RSI) pushed into overbought territory.

- AUD/USD managed to clear the June high (0.7064) in July even though the RSI failed to retain the upward trend from earlier this year, with the exchange rate pushing to fresh yearly highs in August and September to trade at its highest level since 2018.

- The RSI instilled a bullish outlook for AUD/USD during the same period as it threatened the downward trend from earlier this year to push into overbought territory for the fourth time in 2020, but a textbook sell-signal emerged as the indicator quickly slipped back below 70.

- The RSI established a downward trend in September as the indicator fell to its lowest level since April, but the bearish momentum has abated as the RSI failed to push into oversold territory to reflect the extreme readings seen in March.

- As a result, it seems as though the correction from the yearly high (0.7414) was an exhaustion in the bullish trend rather than a change in behavior as AUD/USD cleared the October high (0.7243) earlier this month, with the move back above the 0.7270 (23.6% expansion) region bringing the Fibonacci overlap around 0.7370 (38.2% expansion) to 0.7390 (38.2% expansion) on the radar.

- Need a closing price above the overlap around 0.7370 (38.2% expansion) to 0.7390 (38.2% expansion) to open up the 0.7480 (50% expansion) area, with the next region of interest coming in around 0.7560 (50% expansion) to 0.7580 (61.8% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong