Canadian Dollar Talking Points

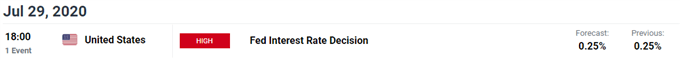

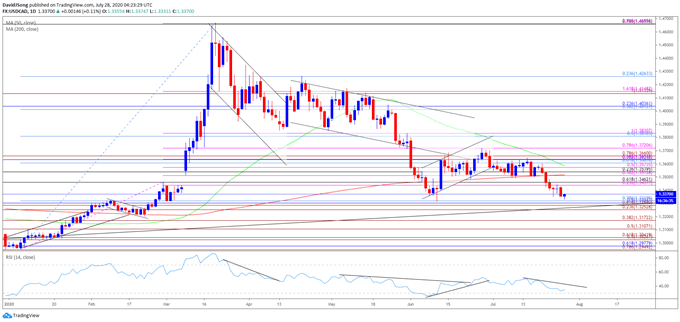

USD/CAD trades to a fresh monthly low (1.3425) going into the end of July, and the bearish price action may persist ahead of the Federal Reserve interest rate decision on July 29 as the Relative Strength Index (RS) approaches oversold territory.

USD/CAD Rate Eyes March Low Ahead of FOMC Rate Decision

USD/CAD appears to be on track to test the June low (1.3315) after snapping the range bound price action from earlier this month, and the Canadian Dollar may continue to outperform the greenback as the Federal Open Market Committee (FOMC) vows to “increase its holdings of Treasury securities and agency MBS (Mortgage-Backed Security) and agency CMBS (Commercial Mortgage-Backed Security) at least at the current pace.”

More of the same from the FOMC may keep USD/CAD under pressure as the Fed’s balance sheet looks poised to cross back above $7 trillion, and the central bank may continue to utilize its lending facilities along with its asset purchases to combat the economic shock from COVID-19 as Chairman Jerome Powell and Co. remain “committed to using our full range of tools to support the economy in this challenging time.”

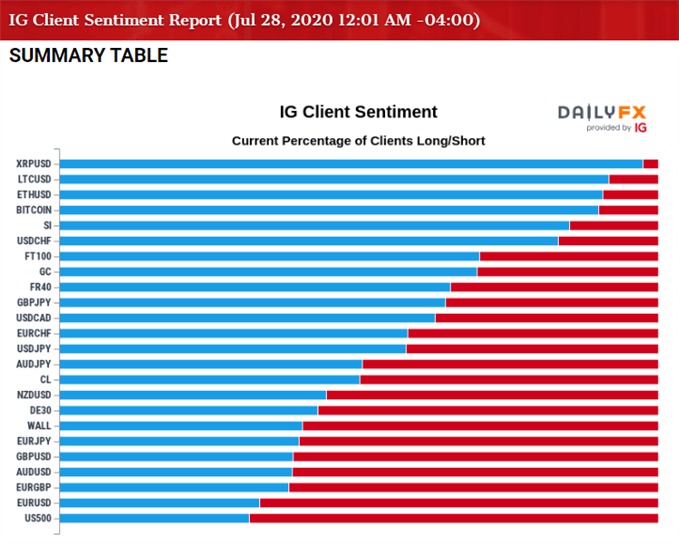

In turn, current market conditions may carry into August if the FOMC retains a dovish forward guidance for monetary policy, and the crowding behavior in the US Dollar looks poised to persist as the IG Client Sentiment shows retail traders still net-long USD/CHF, USD/CAD and USD/JPY, while the crowd remains net-short NZD/USD, GBP/USD, AUD/USD and EUR/USD.

With that said, USD/CAD appears to be on track the June low (1.3315) as it extends the decline from earlier this month, and the Relative Strength Index (RSI) may show the bearish momentum gathering pace if the indicator registers an extreme reading like the behavior seen during the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the USD/CAD correction from the 2020 high (1.4667) managed to fill the price gap from March, with the decline in the exchange rate pushing the Relative Strength Index (RSI) into oversold territory for the first time since the start of the year.

- Nevertheless, USD/CAD reversed from the March low (1.3315) in June, with both price and the RSI carving an upward trend during the previous month, but the bullish formations have been largely negated as the exchange rate snapped the range bound price action from earlier this month.

- In turn, the March low (1.3315) sits on the radar, but lack of momentum to break/close below the Fibonacci overlap around 1.3440 (23.6% expansion) to 1.3460 (61.8% retracement) may keep USD/CAD within the June range as the RSI appears to be flattening out ahead of oversold territory.

- Nevertheless, will keep a close eye on the RSI as it establishes a downward trend in July, with a break below 30 likely to be accompanied by a further decline in USD/CAD like the price action seen in June.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong