Australian Dollar Talking Points

AUD/USD continues to pullback from the monthly high (0.7001) even though Australia Treasurer Josh Frydenberg unveils another A$750 economic support payment, and the exchange rate may consolidate ahead of Australia’s Employment report amid the failed attempt to test the 2020 high (0.7064).

AUD/USD Rate Outlook Mired by Failure to Test 2020 High

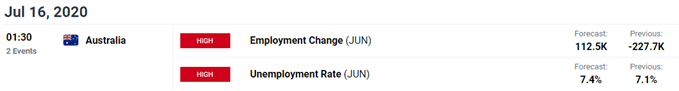

AUD/USD tracks a narrow range following the limited reaction to the Reserve Bank of Australia (RBA) interest rate decision, but the update to Australia’s Employment may influence the exchange rate as the economy is expected to add 112.5K jobs in June.

At the same time, the Unemployment Rate is projected to increase to 7.4% from 7.1% in May as discouraged workers return to the labor force, and a positive development may trigger a bullish reaction in the Australian Dollar as it saps speculation for additional monetary support.

A rebound in employment along with the proactive approach by fiscal authorities is likely to keep the RBA on the sidelines as the economic shock from COVID-19 “has been less severe than earlier expected,” and Governor Philip Lowe and Co. may continue to endorse a wait-and-see approach at the next interest rate decision on August 4 as the central bank vows to “not increase the cash rate target until progress is being made towards full employment.”

However, it remains to be seen if fiscal authorities will continue to support the economy as programs like the Jobkeeper Paymentis set to expire on September 27, and the RBA may come under pressure to provide additional monetary support as Standard and Poor’s and Fitch Ratings cut Australia’s credit rating outlook to ‘negative’ from ‘stable.’

Until then, the resilience in the Australian Dollar may persist as the RBA reveals that “the Bank has not purchased government bonds for some time,” but lack of momentum to test the 2020 high (0.7064) may generate a near-term correction in AUD/USD as the RSI appears to be reversing course ahead of overbought territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

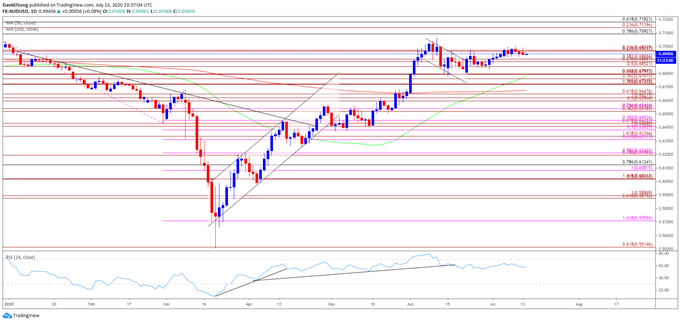

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the advance from the yearly low (0.5506) gathered pace as AUD/USD broke out of the April range, with the exchange rate clearing the February high (0.6774) as the Relative Strength Index (RSI) pushed into overbought territory.

- However, AUD/USD appears to be stuck in a narrow range after trading to a fresh 2020 high (0.7064) in June, and the exchange rate may continue to consolidate in July as the RSI fails to retain the bullish trend from earlier this year, with the oscillator reversing course ahead of overbought territory.

- The string of failed attempts to close above the 0.6970 (23.6% expansion) to 0.6980 (23.6% expansion) region keeps the Fibonacci overlap around 0.6720 (78.6% expansion) to 0.6800 (61.8% expansion) on the radar as AUD/USD trades within the June range.

- Need a break/close above the 0.6970 (23.6% expansion) to 0.6980 (23.6% expansion) region to open up the 2020 high (0.7064), with the next area of interest coming in around 0.7090 (78.6% retracement), which largely lines up with the July 2019 high (0.7082).

- At the same time, a break/close below Fibonacci overlap around 0.6720 (78.6% expansion) to 0.6800 (61.8% expansion) opens up the downside targets, with the first area of interest coming in around 0.6600 (50% expansion) to 0.6650 (61.8% expansion), which largely lines up with the June low (0.66480).

- Next area of interest comes in around 0.6520 (38.2% expansion) 0.6540 (78.6% expansion) followed by the overlap around 0.6380 (50% expansion) to 0.6450 (38.2% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong