EUR/USD Rate Talking Points

EUR/USD appears to be stuck in a narrow range ahead of the update to the US Non-Farm Payrolls (NFP) report, but a bull flag formation may unfold over the coming days as the Relative Strength Index (RSI) continues to track the bullish trend from earlier this year.

EUR/USD RSI Retains Bullish Trend Ahead of US Employment Report

EUR/USD is little changed from earlier this week even though European Central Bank (ECB) Chief Economist Philip Lane insists that the Euro Area is in “the second stage of recovery,” and it remains to be seen if the US Non-Farm Payrolls (NFP) report will influence the exchange rate as employment is expected to increase for the second consecutive month.

The US economy is anticipated to add 3 million jobs in June following the 2.5 million expansion the month prior, and a positive development may trigger a bullish reaction in the US Dollar as it undermines speculation for additional monetary support.

In turn, the Federal Open Market Committee (FOMC) may stick to the sidelines at the next interest rate decision on July 29 as Chairman Jerome Powell tells US lawmakers that “we entered an important new phase and have done so sooner than expected.”

The European Central Bank (ECB) may follow a similar path as board member Lane anticipates “a long period where the data should be mostly positive,” and it seems as though the central bank has little intentions of implementing more non-standard tools as the official speaks out against a yield-curve control program.

Lane asserts that “you can only target the yield if you promise to buy everything, which we do not,” and the comments suggest the ECB will carry out a wait-and-see approach as board member Yves Mersch reveals that “a COVID-19 recovery fund “would reduce the burden on monetary policy and the need for further easing of the policy stance.”

Looking ahead, the ECB may stick to the same script at the next meeting on July 16 as European Council President Charles Michel vows to ‘start real negotiations with the member states, and will convene an in-person summit, around mid-July in Brussels,’ but the central bank may stand ready to “adjust all of its instruments” as Governing Council officials rule out a V-shape recovery.

Nevertheless, the reluctance to implement lower interest rates may keep EUR/USD afloat as President Christine Lagarde and Co. appear to be on track to retain the current policy, and the exchange rate may stage another attempt to test the March high (1.1495) as a bull flag formation takes shape, while the Relative Strength Index (RSI) clings to the bullish trend from March.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

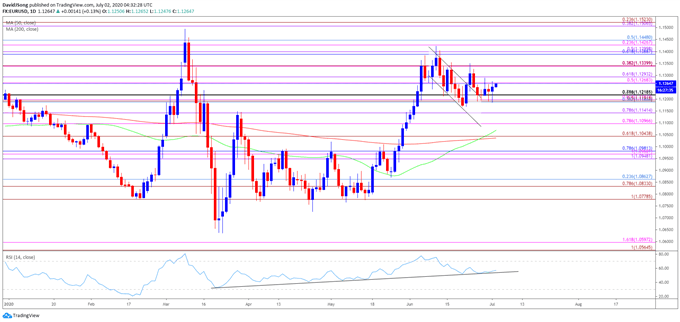

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range was a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- However, the opening range for March was less relevant amid the pickup in volatility, with the pullback from the yearly high (1.1495) producing a break of the February low (1.0778) as the exchange rate slipped to a fresh 2020 low (1.0636).

- Nevertheless, EUR/USD appeared to be on track to test the March high (1.1495) after breaking out of the April range, but the exchange rate appears to be stuck in a narrow range following the failed attempt to close above the Fibonacci overlap around 1.1390 (61.8% retracement) to 1.1400 (50% expansion).

- It remains to be seen if a bull flag formation will unfold over the coming days asa ‘golden cross’ takes shape, with the 50-Day SMA (1.1069) crossing above the 200-Day SMA (1.1036) ahead of the second half of the year.

- The Relative Strength Index (RSI) appears to be validating the continuation patterns as the oscillator reacts to trendline support and preserves the bullish trend from earlier this year.

- Lack of momentum to trade below the 1.1190 (38.2% retracement) to 1.1220 (78.6% expansion) area has pushed EUR/USD back towards the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion), but need a break/close above 1.1340 along with an extension of the bullish RSI formation to bring the 1.1390 (61.8% retracement) to 1.1400 (50% expansion) region on the radar.

- Next area of interest comes in around 1.1430 (23.6% expansion) to 1.1450 (50% retracement), which largely lines up with the June high (1.1423), followed by March high (1.1495), which aligns with the overlap around 1.1510 (38.2% expansion) to 1.1520 (23.6% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong