New Zealand Dollar Talking Points

NZD/USD has come up against the March high (0.6448) after clearing the 200-Day SMA (0.6312), and the bullish momentum may persist throughout the remainder of the week as the Relative Strength Index (RSI) pushes into overbought territory.

NZD/USD Comes Up Against March High as RSI Pushes into Overbought Zone

NZD/USD extends the advance from the start of the month as the greenback weakens against all of its commodity bloc currency counterparts, and the advance from the 2020 low (0.5469) may continue to evolve as the Federal Reserve prepares to have the Municipal Liquidity Facility along with the Main Street Lending Program up and running in June.

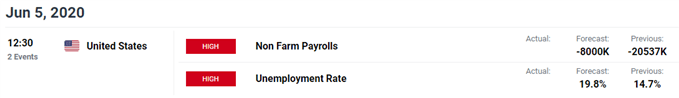

Looking ahead, the update to the US Non-Farm Payrolls (NFP) report may keep NZD/USD afloat as the economy is expected to shed 8 million jobs in May, and the data may influence the monetary policy outlook as the Federal Open Market Committee (FOMC) remains committed in “using its full range of tools to support the U.S. economy in this challenging time.”

However, the new set of non-standard measures may push the FOMC to the sidelines as the balance sheet climbs above $7 trillion in May, and Chairman Jerome Powell and Co. may merely attempt to buy time at the next interest rate decision on June 10 as Fed officials express mixed views regarding the US economy.

The Reserve Bank of New Zealand (RBNZ) may carry out a similar approach after expanding the Large Scale Asset Purchase (LSAP) programin May to NZ$60 billion from NZ$33 billion, but it remains to be seen if Governor Adrian Orr and Co. will implement a negative interest rate policy (NIRP) in 2021 as Chief Economist Yuong Ha reveals that “we’ve given the banking system until the end of the year to get ready so that the option is there for the Monetary Policy Committee (MPC) in a year’s time.”

Until then, it seems as though the RBNZ will rely on its balance sheet to support the New Zealand economy as “the Committee agreed that it will stand ready to deploy further tools as needed, should the need for stimulus continue to increase,” and speculation for a NIRP in New Zealand may drag on NZD/USD later this year especially as Federal Reserve Chairman Jerome Powell tames bets for negative US interest rates.

Nevertheless, the advance from the 2020 low (0.5469) may continue to evolve as NZD/USD comes up against the March high (0.6448) after clearing the 200-Day SMA (0.6312), and the bullish momentum may persist throughout the remainder of the week as the Relative Strength Index (RSI) pushes into overbought territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

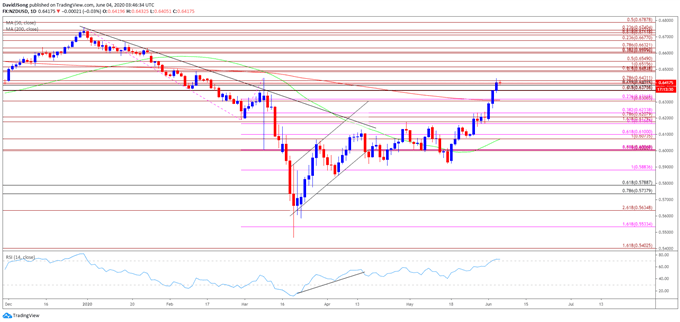

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, NZD/USD has failed to retain the range from the second half of 2019 as the decline from earlier this year produced a break of the October low (0.6204), with a ‘death cross’ taking shape in March as the 50-Day SMA (0.6049) crossed below the 200-Day SMA (0.6311).

- The negative slope in the 200-Day SMA offer a bearish outlook for NZD/USD, but the recent shift in the 50-Day SMA highlights a potential change in market behavior, with the Relative Strength Index (RSI) highlighting a similar dynamic.

- Will keep a close eye on the RSI as the break above 70 offers a bullish signal, and the advance in NZD/USD may persist as long as the oscillator holds in overbought territory.

- Need a break/close the 0.6400 (61.8% retracement) to 0.6430 (78.6% expansion) region to open up the Fibonacci overlap around 0.6490 (50% expansion) to 0.6520 (100% expansion), with the next area of interest coming in around 0.6550 (50% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong