Australian Dollar Talking Points

AUD/USD clears the March high (0.6685)after breaking out of the April range, and the Reserve Bank of Australia (RBA) interest rate decision may keep the exchange rate afloat if the central bank tames speculation for additional monetary support.

AUD/USD Rate Clears March High Ahead of RBA Interest Rate Decision

The Australian Dollar has outperformed against all of its major counterparts in May, and AUD/USD may continue to exhibit a bullish behavior in June as the RBA is expected to keep the official cash rate (OCR) at the record low of 0.25%.

Recent remarks from Governor Philip Lowe suggests the RBA will carry a wait-and-see approach over the coming months as he tells Australian lawmakers that “the evidence so far is that our mid-March package is working as expected and it is helping build the necessary bridge to the recovery,” with the central bank head going onto say that “it's entirely possible that the economic downturn will not be as severe as earlier thought.”

At the same time, Governor Lowe argues that “fiscal policy will have to play a more significant role in managing the economic cycle than it has in the past” amid the limitations surrounding monetary policy, and it seems as though the RBA will “keep interest rates where they are perhaps for years” amid waning hopes for a V-shaped recovery.

The threat of a protracted recovery may put pressure on the RBA to further support the economy as stimulus programs like the Jobkeeper Payment is set to expire on September 27, and the Australia Dollar is likely to face headwinds if Governor Lowe and Co. revert back to a dovish forward guidance.

Nevertheless, the RBA may continue to tame speculation for additional monetary support at the June 2 meeting as governments across Australia continue to roll back the lockdown laws, and more of the same from Governor Lowe and Co. may trigger a bullish reaction in AUD/USD especially as the Federal Reserve prepares to launch the Municipal Liquidity Facility along with the Main Street Lending Program.

With that said, the Australian Dollar may continue to outperform its major counterparts in June as the RBA abandons the dovish forward guidance for monetary policy, and the break above the March (0.6685) may spur a run at the February high (0.6774) as the Relative Strength Index (RSI) approaches overbought territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

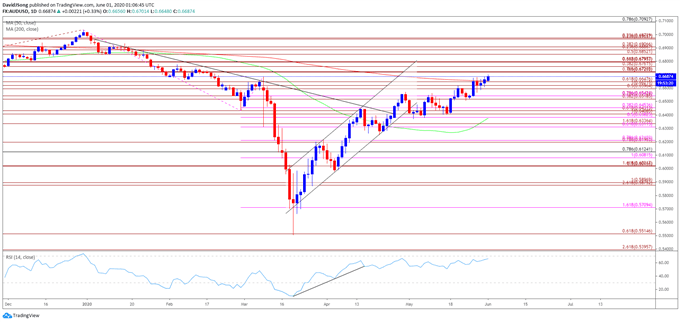

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range was a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- However, the opening range for March was less relevant, with the high of the month occurring on the 9th, the same day as the flash crash.

- Nevertheless, the advance from the yearly low (0.5506) continues to evolve as AUD/USD breaks out of the April range, with the exchange rate clearing the March high (0.6685), while the Relative Strength Index (RSI) approaches overbought territory.

- Will keep a close eye on the RSI as the bullish momentum appears to be gathering pace, with a break above 70 likely to be accompanied by a further advance in AUD/USD.

- The break/close above the former support zone around 0.6600 (50% expansion) to 0.6650 (61.8% expansion) opens up the Fibonacci overlap around 0.6720 (78.6% expansion) to 0.6800 (61.8% expansion), which lines up with the February high (0.6774), with the next area of interest coming in around 0.6850 (to 0.6910 (38.2% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong