EUR/USD Rate Talking Points

EUR/USDretraces the decline from the previous week even though the European Central Bank (ECB) shows a greater willingness to support the Euro Area, and exchange rate may trade within a more defined range over the remainder of the month as the recent rebound fails to trigger a test of the May high (1.1020).

EUR/USD Tracks Monthly Range While ECB Rules Out V-Shape Recovery

EUR/USD snaps the series of lower highs and lows from the previous week despite the opposition (Austria, Denmark, Sweden and the Netherlands) to the EUR500 billion recovery fund drawn up by France and Germany, and the exchange rate may consolidate over the coming days as the European Union (EU) prepares to unveil the seven-year budget on May 27.

It remains to be seen if European officials will make a major announcement as the ECB argues that “fiscal policy also needed to play an essential role,” and the Governing Council may retain a proactive approach in combating the economic shock from COVID-19 as “growth scenarios produced by ECB staff suggested that euro area GDP could fall by between 5% and 12% this year.”

The account of the ECB’s April meeting warns that “the longer the lockdown measures were in place, the more serious the impact on activity and prices would be,” with President Christine Lagarde and Co. emphasizing that “the economic effects of the pandemic would continue for a considerable period after the coronavirus was contained, as the decline in demand owing to precautionary motives or to income losses could be expected to weigh on economic activity, leading to a slow recovery.”

In turn, the ECB states that “a swift V-shaped recovery could probably already be ruled out at this stage,” and the central bank may take additional steps to support the monetary union as “strong and timely efforts were urgently needed to prepare and support the recovery.”

The comments suggest the ECB will continue to utilize its balance sheet as the Governing Council pledges to “adjust the PEPP (Pandemic Emergency Purchase Programme) and potentially other instruments if it saw that the scale of the stimulus was falling short of what was needed,” and President Lagarde and Co. may announce additional measures at the next meeting on June 4 as the central bank stands “ready to adjust all of its measures, as appropriate, to ensure that inflation moved towards its aim in a sustained manner.”

With that said, the ECB’s dovish forward guidance for monetary policy may present headwinds for the Euro throughout 2020, but EUR/USD may trade within a more defined range over the remainder of the month as the recent rebound in the exchange rate fails to trigger a test of the May high (1.1020).

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

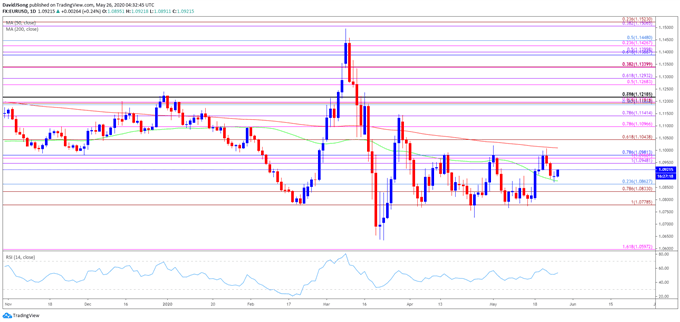

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- However, the opening range for March was less relevant amid the pickup in volatility, with the pullback from the yearly high (1.1495) producing a break of the February low (1.0778) as the exchange rate slipped to a fresh 2020 low (1.0636).

- Nevertheless, EUR/USD may trade within a more defined range as the advance from the April low (1.0727) failed to produce a test of the April high (1.1039), with a similar scenario taking shape this month as the advance during the previous week failed to trigger a test of the May high (1.1020).

- In turn, the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) is back on the radar for EUR/USD as the exchange rate snaps the recent series of lower highs and lows following the failed attempt to break/close below the 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement) region.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong