Gold Price Talking Points

The price of gold may consolidate throughout the final week of May even though a growing number of Federal Reserve officials warn of a protracted recovery as the Relative Strength Index (RSI) reverses course ahead of overbought territory and establishes a negative slope.

Gold Price Outlook Mired Ahead of June by Negative RSI Slope

The price of gold may continue to pull back from the 2020 high ($1765) as the advance from earlier this month stalls ahead of the 2012 high ($1796), but the weakness may end up being short lived as bullion has traded to fresh yearly highs during every single month so far in 2020.

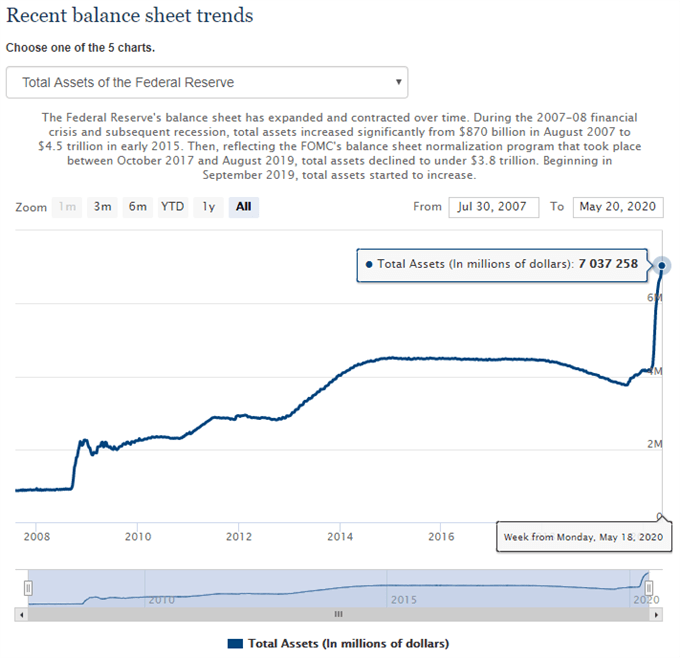

It remains to be seen if the bullish behavior in gold will persist in June as the Federal Reserve prepares to launch the Municipal Liquidity Facility along with the Main Street Lending Program, and the central bank appears to be on track to actively expand its balance sheet over the coming months as Vice-Chairman Richard Clarida warns that the US economy is expected to “contract at an unprecedented pace in the second quarter.”

Boston Fed President Eric Rosengren shared similar remarks during an interview with CBS as he anticipates “double digit unemployment through the end of this year,” with the official going onto say that it would take “a vaccine or other medical innovations” to restore the US labor market back to full employment.

In turn, Mr. Rosengren insists that the “Federal Reserve is going to continue to do what it needs to try to get – get us back to full employment as quickly as possible,” and the Federal open Market Committee (FOMC) may stick to a dovish forward guidance at the next interest rate decision on June 10 even though the balance sheet climbs above $7 trillion in May.

Source: FOMC

It remains to be seen if the FOMC will deploy more unconventional tools in 2020 as Chairman Jerome Powelltames speculation for a negative interest rate policy (NIRP), but the low interest rate environment along with the ballooning central bank balance sheets may act as a backstop for goldas marketparticipants look for an alternative to fiat-currencies.

With that said, the price for gold may continue to exhibit a bullish behavior in June as it trades to fresh yearly highs during every single month so far in 2020, but the precious metal may consolidate over the remainder of the month as the Relative Strength Index (RSI) reverses course ahead of overbought territory and establishes a negative slope.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- However, the monthly opening range for March as less relevant amid the pickup in volatility, with the decline from the monthly high ($1704) leading to a break of the January low ($1517).

- Nevertheless, the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) instilled a constructive outlook for bullion especially as the RSI reversed course ahead of oversold territory and broke out of the bearish formation from February.

- In turn, gold cleared the March high ($1704) to tag a new yearly high ($1748) in April, with the bullish behavior also taking shape in May as the precious metal traded to a fresh 2020 high ($1764).

- The RSI highlighted a similar dynamic as the oscillator broke out of the downward trend carried over from the previous month, but the bullish momentum has largely abated as the indicator reverses course ahead of overbought territory.

- Will keep a close eye on the RSI as it establishes a negative slope, and the indicator may register levels not seen since March if the oscillator breaks below 50.

- The price of gold may continue to pull back from the 2020 high ($1765) as the advance from earlier this month stalls ahead of the 2012 high ($1796), with lack of momentum to hold above the Fibonacci overlap around $1733 (78.6% retracement) to $1743 (23.6% expansion) bringing the $1676 (78.6% expansion) region on the radar, which largely lines up with the May low ($1670).

- Next area of interest comes in around $1655 (161.8% expansion) followed by the overlap around $1627 (61.8% expansion) to $1630 (23.6% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong