Canadian Dollar Talking Points

USD/CAD consolidates ahead of the update to Canada’s Consumer Price Index (CPI), and the exchange rate may continue to track the April range as Bank of Canada (BoC) Governor Stephen Poloz prepares to depart from the central bank.

USD/CAD Rate Forecast: May High on the Radar Ahead of Canada CPI

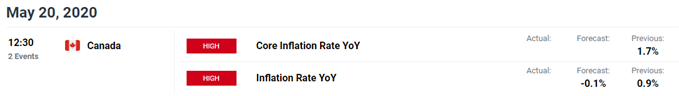

USD/CAD gives back the advance from the previous week as Federal Reserve Chairman Jerome Powell warns of a protracted recovery, but fresh data prints coming out of Canada may keep the exchange rate afloat as the headline reading for inflation is expected to contract for the first time since 2009.

Canada’s CPI is projected to decline 0.1% in April after expanding 0.9% per annum the month prior, and the economic shock from COVID-19 may force the Bank of Canada (BoC) to implement more non-standard measures as the “Governing Council stands ready to adjust the scale or duration of its programs if necessary.”

In turn, the BoC under Tiff Macklem may continue to push monetary policy into uncharted territory as economic activity “will be 15-30 percent lower in the second quarter than in fourth-quarter 2019,” and the central bank may stick to a dovish forward guidance at the next meeting on June 3 as Canada’s Unemployment Rate jumps to 13.0% from 7.8% in March.

With that said, the Canadian Dollar may face headwinds throughout 2020 as the BoC keeps the door open to deploy more unconventional tools, and the broader outlook for USD/CAD remains constructive as the exchange rate breaks out of the descending channel from earlier this year.

However, USD/CAD may continue to consolidate over the coming days as it preserves the April range, with the failed attempt to test the monthly low (1.3900) bringing the May high (1.4173) on the radar.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

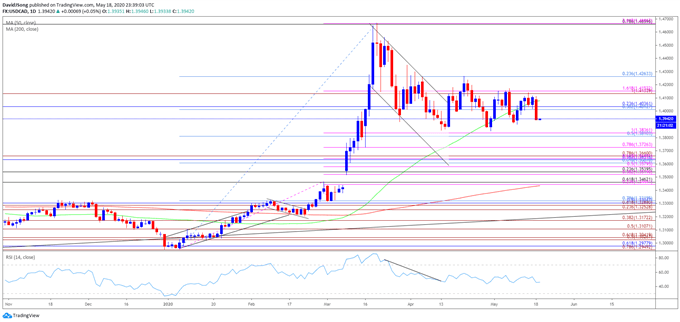

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, the near-term rally in USD/CAD emerged following the failed attempt to break/close belowthe Fibonacci overlap around 1.2950 (78.6% expansion) to 1.2980 (61.8% retracement), with the yearly opening range highlighting a similar dynamic as the exchange rate failed to test the 2019 low (1.2952) during the first full week of January.

- The shift in USD/CAD behavior may persist in 2020 as the exchange rate breaks out of the range bound price action from the fourth quarter of 2019 and clears the October high (1.3383).

- However, recent price action warns of range bound conditions as the break of the descending channel formation failed to produce a test of the April high (1.4298), with the recent decline in USD/CAD sputtering ahead of the April low (1.3850).

- In turn, USD/CAD may trade within a more defined range as the decline from the start of the week fails to produce a test of the monthly low (1.3900), with a move above the Fibonacci overlap around 1.4010 (38.2% retracement) to 1.4040 (23.6% retracement) bringing the 1.4130 (100% expansion) to 1.4150 (161.8% expansion) region on the radar as it largely lines up with the May high (1.4173).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong