Gold Price Talking Points

The price of gold appears to be stuck in a narrow range following the limited reaction to the US Non-Farm Payrolls (NFP) report, and the precious metal may continue to consolidate as plans to gradually restart the advanced economies spur speculation for a V-shaped recovery.

Gold Price Consolidation Unfazed by NFP Report, Dovish Fed Rhetoric

The price of gold is little changed from the start of the month as President Donald Trump tweets that “the USA will be purchasing, from our Farmers, Ranchers & Specialty Crop Growers, 3 Billion Dollars worth of Dairy, Meat & Produce for Food Lines & Kitchens,” and the unprecedented efforts by fiscal as well as monetary authorities may continue to restore investor confidence as Great Lockdown appears to have passed its peak.

In response, central banks may carry out a wait-and-see approach over the coming months as the Reserve Bank of Australia (RBA) insists “gradual recoveries should follow in the second half of the year, supported by the easing of restrictions and the significant expansion in both fiscal and monetary policies,” and the response to the coronavirus may generate a V-shaped recovery as the Federal Reserve and its major counterparts expand their balance sheets in 2020.

However, Minneapolis Fed President Neel Kashkari, a 2020-voting member on the Federal Open Market Committee (FOMC), warns that “the worst is yet to come on the job front” during an interview on ABC, and went onto say that “Congress is going to need to continue to give assistance to workers who’ve lost their jobs” as major cities like New York remain on lockdown.

In turn, the slew of unconventional monetary policy tools may do little to jumpstart global growth as the FOMC emphasizes that “the “timing of the resumption of growth in the U.S. economy depended on the containment measures put in place,” and threat of a protracted recovery may push major central banks to deploy more non-standard measures as Chairman Jerome Powelland Co. remain “committed to using our full range of tools to support the economy in this challenging time.”

With that said, the low interest rate environment along with the ballooning central bank balance sheets may act as a backstop for goldas marketparticipants look for an alternative to fiat-currencies, but the price for bullion may continue to consolidate following the string of failed attempt to test the November 2012 high ($1754) as the Relative Strength Index (RSI) preserves the bearish formation carried over from the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

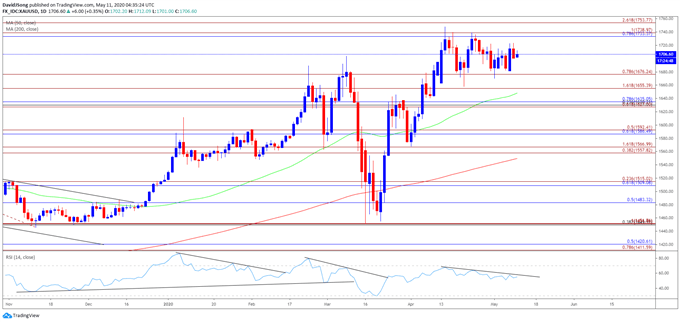

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- However, the monthly opening range for March as less relevant amid the pickup in volatility, with the decline from the monthly high ($1704) leading to a break of the January low ($1517).

- Nevertheless, the reaction to the former-resistance zone around $1450 (38.2% retracement) to $1452 (100% expansion) instilled a constructive outlook for bullion especially as the RSI reversed course ahead of oversold territory and broke out of the bearish formation from February.

- The break/close above $1710 (100% expansion) pushed the price of gold to a fresh yearly high ($1748) in April, but the precious metal continue to consolidate following the string of failed attempt to test the November 2012 high ($1754), while as the RSI preserves the bearish formation carried over from the previous month.

- Will keep a close eye on the RSI as it approaches trendline resistance, with a break of the downward trend likely to be accompanied by higher gold prices as the bearish momentum abates.

- Still need break/close above the Fibonacci overlap around $1733 (78.6% retracement) to $1739 (100% expansion) to bring the $1754 (261.8% expansion) region on the radar, which lines up with the November 2012 high ($1754).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong