Australian Dollar Talking Points

AUD/USD continues to trade in a narrow range amid the limited reaction to the US Non-Farm Payrolls (NFP) report, but the failed attempt to test the March high (0.6685) warns of a potential shift in market behavior as the exchange rate snaps the upward trending channel carried over from March.

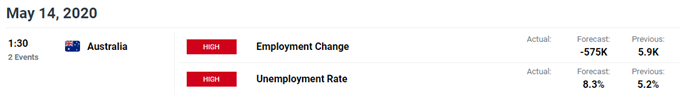

AUD/USD Rate to Face Record Drop in Australia Employment

AUD/USD trades near the monthly high (0.6548) ahead of Australia’s Employment report, but the update may drag on the exchange rate as the economy is expected to shed 575K jobs in April, which would mark the biggest decline since the data series began in 1978.

At the same time, the jobless rate is projected to increases to 8.3% from 5.2% in March, and the economic shock from COVID-19 may put pressure on the Reserve Bank of Australia (RBA) to further support the economy as the central bank anticipates unemployment to “remain elevated for some time.”

It remains to be seen if the RBA will continue to push monetary policy into uncharted territory as the quarterly Statement on Monetary Policy warns that the “headline inflation is expected to turn negative in the June quarter, for the first time since the early 1960s,” and Governor Philip Lowe and Co. may strike a more dovish tone over the coming months as fiscal stimulus programs like the Jobkeeper Payment is set to expire on September 27.

In turn, the RBA may show a greater willingness to deploy more unconventional tools in 2020 as “the speed and timing of the economic recovery is very uncertain,” but the central bank may attempt to buy time at the next meeting on June 2 as “gradual recoveries should follow in the second half of the year, supported by the easing of restrictions and the significant expansion in both fiscal and monetary policies.”

With that said, the Australian Dollar is likely to face headwinds if the RBA reverts back to a dovish forward guidance, and the failed attempt to test the March high (0.6685) warns of a potential shift in AUD/USD behavior as the exchange rate snaps the upward trending channel carried over from the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

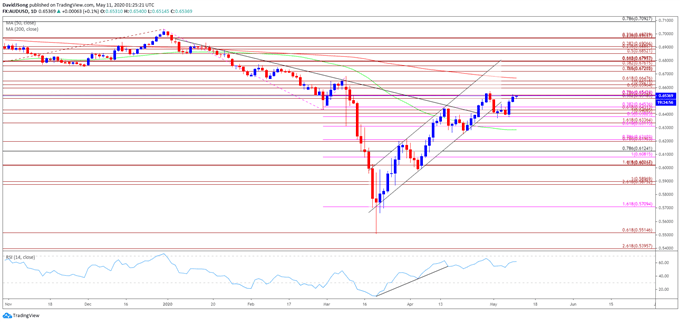

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- However, the opening range for March was less relevant, with the high of the month occurring on the 9th, the same day as the flash crash.

- Nevertheless, the advance from the yearly low (0.5506) appears to have stalled ahead of the March high (0.6685) as AUD/USD finally snaps the upward trending channel, with the Relative Strength Index highlighting a similar dynamic as the oscillator fails to break above 70 and reverses course ahead of overbought territory.

- Need a break/close below the 0.6380 (50% expansion) to 0.6450 (38.2% expansion) region to bring the Fibonacci overlap around 0.6310 (61.8% expansion) to 0.6340 (161.8% expansion) on the radar.

- Next area of interest comes in around 0.6200 (78.6% expansion) to 0.6210 (78.6% expansion) followed by the overlap around 0.6080 (100% expansion) to 0.6120 (78.6% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

https://www.dailyfx.com/registerToSeminar?webinar=7802660476026747393?ref-author=Song