New Zealand Dollar Talking Points

NZD/USD attempts to retrace the decline from earlier this week even though the Reserve Bank of New Zealand (RBNZ) endorses a dovish forward guidance for monetary policy, but the exchange rate may exhibit a more bearish behavior following the failed attempt to test the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion).

NZ Dollar Outlook Mired by Failed Attempt to Test Former Support Zone

NZD/USD bounces back from the weekly low (0.5922) ahead of China’s Gross Domestic Product (GDP) report, and the update may undermine the recent rebound in the exchange rate as the growth rate is expected to contract 6.0% per annum in the first quarter of 2020.

The weakening outlook for the Asia/Pacific region may drag on NZD/USD as it puts pressure on the RBNZ to further support the economy, and the central bank may continue to push monetary policy into uncharted territory as Governor Adrian Orr strikes a dovish tone in front of New Zealand lawmakers.

Recent remarks from Governor Orr suggest the RBNZ will continue to deploy unconventional tools to combat the slowdown in economic activity as the central bank head reveals that “we haven’t ruled out negative interest rates, we just chose the quantitative easing path first.”

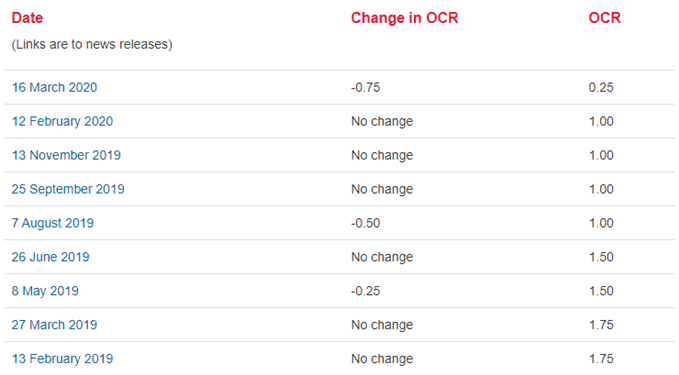

Source: RBNZ

Governor Orr went onto say that the Monetary Policy Committee (MPC) could also further utilize its balance sheet as the RBNZ expands the Large Scale Asset Purchase programme (LSAP)to include NZ$ 3B of Local Government Funding Agency (LGFA) debt, and the nationwide lockdown may force the central bank to implement more non-standard measures as New Zealand’s Treasury outlines five different economic scenarios following COVID-19, with the growth rate expected to decline “around 13% in Scenario 1, the least restrictive of the scenarios considered.”

With that said, it remains to be seen if the RBNZ will make a major announcement at its next interest rate decision on May 13 as the central bank plans to “update its economic assessment and the size and scope of the LSAP at its next scheduled meeting,” but the dovish forward guidance may present headwinds for the New Zealand Dollar as RBNZ keeps the door open to implement a negative interest rate policy (NIRP).

In turn, NZD/USDmay exhibit a more bearish behavior following the failed attempt to test the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion), and the exchange rate may struggle to retain the rebound from the yearly low (0.5469) as it snaps the upward trending channel carried over from the previous month.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

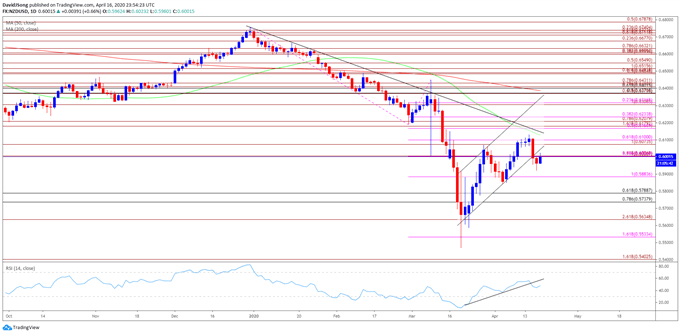

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, NZD/USD has failed to retain the range from the second half of 2019 as the decline from earlier this year produced a break of the October low (0.6204), with a ‘death cross’ taking shape in March as the 50-Day SMA (0.6185) crosses below the 200-Day SMA (0.6408).

- The negative slope in both the 50-Day SMA and the 200-Day SMA offer a bearish outlook for NZD/USD, but recent price action raises the scope for a larger correction as the exchange rate negates a bear flag formation and breaks out of a narrow range, while the Relative Strength Index (RSI continues to track the upward trend carried over from the previous month.

- Break/close above the Fibonacci overlap around 0.6070 (100% expansion) to 0.6100 (61.8% expansion) brings the former support zone around 0.6170 (50% expansion) to 0.6230 (38.2% expansion) on the radar, with the next area of interest coming in around 0.6310 (100% expansion) to 0.6320 (23.6% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong