EUR/USD Rate Talking Points

EUR/USD continues to give back the advance from the yearly low (1.0636) as there appears to be a rift within the European Central Bank (ECB), and the exchange rate may exhibit a more bearish behavior over the coming days as it extends the series of lower highs and lows from earlier this week.

EUR/USD Levels to Watch as Rebound from 2020 Low Unravels

EUR/USD remains under pressure as ECB board member Yannis Stournaras insist that “now is the time for common action and solidarity,” with the official going onto say that “common issuance of debt is common action against the common enemy”during an interview with Bloomberg News.

The comments suggest there’s a split within ECB as “there are proposals to use the European Stability Mechanism or the European Investment Bank,” and the Governing Council may merely buy time at its next meeting on April 30 as the central bank carries out the Pandemic Emergency Purchase Programme (PEPP).

It remains to be seen if the ECB will implement more non-standard measures to combat the weakening outlook for growth as the central bank remains reluctant to remains reluctant to push the main refinance rate, the benchmark for borrowing costs, into negative territory, but the Governing Council may continue to push monetary policy into uncharted territory as Vice President Luis de Guindos warns of a looming recession.

In turn, the ECB may continue to endorse a dovish forward guidance as President Christine Lagarde emphasizes that the Governing Council is “fully prepared to increase the size of our asset purchase programmes and adjust their composition, by as much as necessary and for as long as needed,” and the current environment may keep EUR/USD under pressure as the US Dollar benefits from the flight to safety.

With that said, the recent rebound in EUR/USD may continue to unravel over the coming days as the exchange rate extends the series of lower highs and lows from earlier this week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

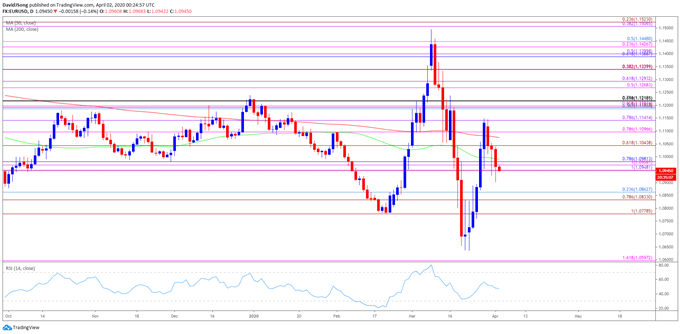

EUR/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- However, the opening range for March has become less relevant amid the pickup in volatility, with the pullback from the yearly high (1.1495) producing a break of the February low (1.0778) as the exchange rate slipped to a fresh 2020 low (1.0636).

- Nevertheless, the recent rebound in EUR/USD appears to have stalled amid the string of failed attempt to close above the 1.1140 (78.6% expansion) region, and the exchange rate may exhibit a bearish behavior over the coming days as it extends the series of lower highs and lows from earlier this week.

- A close below the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) bring the 1.0830 (78.6% expansion) to 1.0860 (23.6% retracement) region on the radar, with the next area of interest coming around 1.0780 (100% expansion) followed by the yearly low (1.0636).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong