Gold Price Talking Points

The price of gold bounces back from the weekly low ($1625) as COVID-19 shows no signs of slowing down, and fears surrounding the coronavirus may keep the precious metal afloat as the outbreak dampens the outlook for global growth.

Bullish Gold Price Behavior to Persist as Coronavirus Spreads

Gold has marked the longest winning streak since June, with the price for bullion trading at its highest level since 2013, and the precious metal may continue to exhibit a bullish behavior as market participants look for an alternative to fiat currencies.

The weakening outlook for global growth is likely to put pressure on major central banks to provide monetary support, and the low interest rate environment may heighten the appeal of gold as authorities like the European Central Bank (ECB) rely on non-standard measures to support Euro area.

It remains to be seen if the ECB will venture into uncharted territory as the Governing Councilremains reluctant to push the main refinance rate, the benchmark for borrowing costs, into negative territory, but the central bank appears to be on track to expands its balance sheet throughout 2020 as President Christine Lagarde and Co. “stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner.”

However, the reliance on unconventional tools may ultimately lead to unintended consequences as the ballooning balance sheet raises the risk for monetary financing, and the price of gold may continue to benefit from the low interest environment as market participants look for an alternative to fiat-currencies.

With that said the broader outlook for bullion remains constructive as the reaction to the former-resistance zone around $1447 (38.2% expansion) to $1457 (100% expansion) helped to rule out the threat of a Head-and-Shoulders formation.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

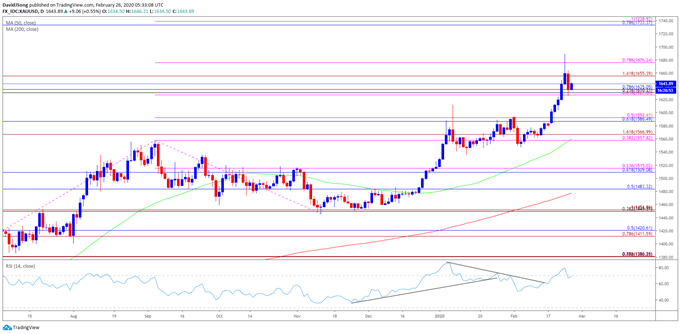

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- In turn, the monthly opening range for March is in focus, and the bullish behavior may persist over the coming days as the RSI on a weekly time frame also pushes into overbought territory.

- Need a close above the $1676 (78.6% expansion) region to open up the Fibonacci overlap around $1733 (78/6% retracement) to $1739 (100% expansion).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong