EUR/USD Rate Talking Points

EUR/USD bounces back from a fresh monthly low (1.1070) ahead of the European Central Bank (ECB) interest rate decision, but the opening range for 2020 raises the scope for a further decline in the exchange rate as the correction from last year failed to produce a test of the August high (1.1250).

EUR/USD January Opening Range Casts Bearish Outlook with ECB on Hold

EUR/USD may show a limited reaction to the ECB’s first meeting for 2020 as the central bank is widely expected to retain the current policy.

President Christine Lagarde and Co. may merely attempt to buy time as the Governing Council conducts a strategic review for the first time since 2003, but it remains to be seen if the ECB will alter the forward guidance for monetary policy as the US and France reach a trade truce, with French President Emmanuel Macron pledging to “work together on a good agreement to avoid tariff escalation.”

The narrowing threat of a trade war may encourage the ECB to tame speculation for lower interest rates as the central bank remains reluctant to push the main refinance rate, the benchmark for borrowing costs, into negative territory. In turn, a less dovish statement from the ECB may curb the recent decline in EUR/USD, but the ongoing shift in US trade policy may keep the Governing Council on its toes as US President Donald Trump pledges to impose auto tariffs against the EU “if they don’t make a deal that’s a fair deal.”

With that said, President Lagarde and Co. may emphasize that “the Governing Council continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner,” and the ongoing threat of a US-EU trade war may drag on the Euro as the ECB relies on non-standard measures to support the monetary union.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

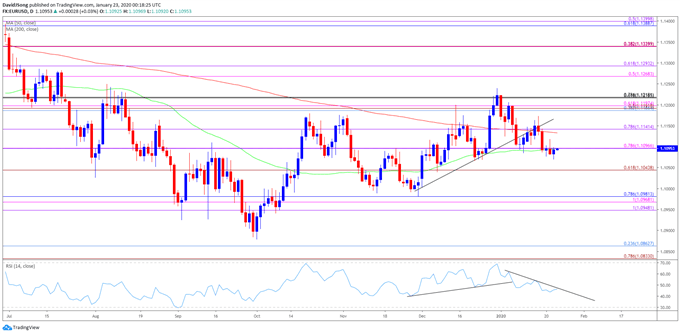

EUR/USD Rate Daily Chart

Source: Trading View

- The broader outlook for EUR/USD remains tilted to the downside as the exchange rate cleared the May-low (1.1107) following the Federal Reserve rate cut in July, with Euro Dollar trading to a fresh yearly-low (1.0879) during the first week of October.

- The monthly opening range has been a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with monthly high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- With that in mind, the correction from the 2019 low (1.0879) may continue to unravel amid the failed attempt to test the August high (1.1250), and the bearish price action from the start of the month may persist as EUR/USD extends the decline from the December high (1.1239), with the exchange rate snapping the upward trend from December.

- The Relative Strength Index (RSI) highlights similar dynamic as the oscillator failed to preserve the bullish formation from November after failing to push into overbought territory.

- As a result, the lack of momentum to hold above the 1.1100 (78.6% expansion) handle opens up the 1.1040 (61.8% expansion) region, with the next area of interest coming in around 1.0950 (100% expansion) to 1.0980 (78.6% retracement), which lines up with the November low (1.0981).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.