Gold Price Talking Points

The price of gold pares the advance following the US Non-Farm Payrolls (NFP) report, and the Relative Strength Index (RSI) may flash a textbook sell-signal over the coming days as the oscillator struggles to hold in overbought territory.

Gold Price to Stage Larger Pullback on RSI Sell Signal

The price of gold consolidates as US President Donald Trump responds to the Iran attacks with additional sanctions rather than military action, and headlines surrounding the US-China trade agreement may keep the precious metal under pressure as the Phase One deal is expected to be signed later this week.

The narrowing threat of a US-China trade war may undermine the recent break out in the price of bullion as President Trump pledges to visit Beijing at a later date “where talks will begin on Phase Two,” but the ongoing shift in US trade policy may keep gold prices afloat as the Office of the United States Trade Representative (USTR) plans to combat France’s Digital Services Tax by implementing “additional duties of up to 100 percent on certain products of France.”

With that said, it seems as though the Trump administration will continue to rely on tariffs and sanctions to carry out its agenda, and weakening outlook for global growth may push market participants to find a hedge against fiat currencies as the World Bank now projects the world economy to expand “2.5 percent in 2020, 0.2 percentage point below previous forecasts.”

The World Bank warns that “heightened uncertainty surrounding the external environment is likely to persist, amid a fragile global outlook,” and the Federal Reserve as well as the European Central Bank (ECB) may come under pressure to provide monetary support amid the weakening outlook for global growth.

In turn, geopolitical risks paired with speculation for lower interest may keep gold prices afloat as market participants look for an alternative to fiat-currencies.

With that said, the broader outlook for the price of gold remains constructive, with the reaction to the former-resistance zone around $1447 (38.2% expansion) to $1457 (100% expansion) helping to rule out the threat of a Head-and-Shoulders formation as the region acts as support.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

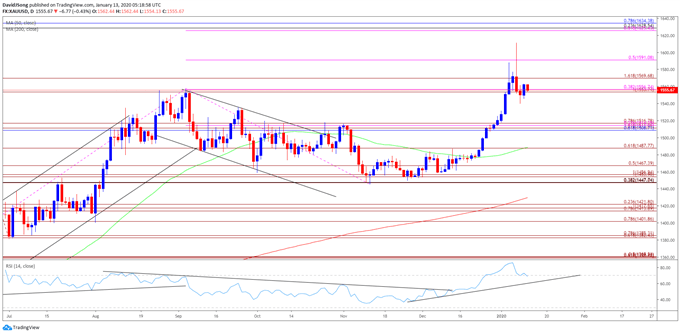

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instills a constructive outlook for the price of gold as the precious metal the 2019 high ($1557), while the Relative Strength Index (RSI) continues to track the bullish formation from December.

- However, the RSI may flash a textbook sell-signal over the coming days as the oscillator struggles to hold it overbought territory.

- The failed attempt to close above $1591 (50% expansion) may spur a move back towards the Fibonacci overlap around $1509 (61.8% retracement) to $1517 (78.6% expansion), with the next region of interest coming in around $1488 (61.8% expansion).

- Need a close above $1591 (50% expansion) to bring the topside targets back on the radar, with the first area of interest coming in around $1625 (61.8% expansion) to $1634 (78.6% retracement).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.