New Zealand Dollar Talking Points

NZD/USD pulls back from the monthly high (0.6576) as attention turns to the Federal Reserve’s last meeting for 2019, and the Relative Strength Index (RSI) may offer a textbook sell-signal as the oscillator struggles to hold in overbought territory.

NZD/USD Rate Forecast: RSI on Cusp of Offering Textbook Sell Signal

NZD/USD fails to extends the series of higher highs and lows from the previous week as the Federal Open Market Committee (FOMC) is widely expected to retain the current policy on December 11.

The Fed interest rate decision may undermine the near-term correction in NZD/USD as the central bank appears to be moving away from its rate easing cycle.

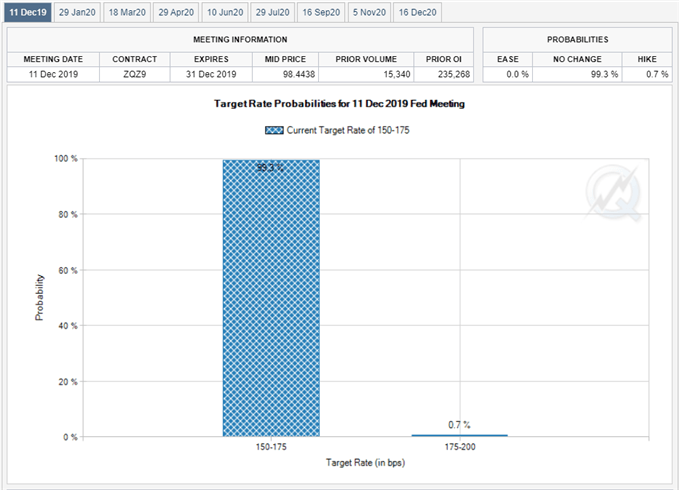

Fed Fund futures continue to show a greater than 90% probability the FOMC will keep the benchmark interest rate in its current threshold of 1.50% to 1.75%, and the update to the US Non-Farm Payrolls (NFP) report may encourage the committee to tame speculation for lower interest rates amid the ongoing improvement in the labor market.

In turn, the FOMC may largely endorse a wait-and-see approach for the foreseeable future as Chairman Jerome Powell and Co. see “the current stance of monetary policy as likely to remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook of moderate economic growth.”

However, it remains to be seen if Fed officials will alter the forward guidance when they update the Summary of Economic Projections (SEP), and a downward revision in the interest rate dot-plot may produce a bearish reaction in the US Dollar as the central bank prepares households and businesses for a more accommodative stance.

The push for greater transparency is likely to influence the financial markets as traders gauge the future path for monetary policy, and a material adjustment to the SEP may keep NZD/USD afloat if Chairman Powell and Co. forecast a lower trajectory for the benchmark interest rate.

Moreover, the ongoing shift in US trade policy may also impact NZD/USD as the Trump administration appears to be on track to raise China tariffs on December 15.

With that said, waning hopes for US-China trade deal may produce headwinds for the New Zealand Dollar, and the near-term correction in NZD/USD may unravel over the coming days as the exchange rate snaps the string of higher highs and lows from the previous week.

At the same time, the Relative Strength Index (RSI) may offer a textbook sell-signal as the oscillator pulls back from overbought territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

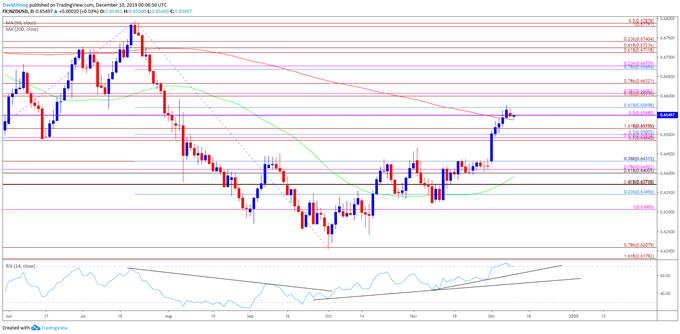

NZD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the broader outlook for NZD/USD remains tilted to the downside as the exchange rate trades to a fresh yearly-low (0.6204) in October.

- However, failure to break/close below the Fibonacci overlap around 0.6180 (161.8% expansion) to 0.6210 (78.6% expansion) has spurred a near-term correction in the exchange rate, with the exchange rate climbing back above the former-support zone around 0.6490 (50% expansion) to 0.6520 (100% expansion).

- Need a close above the Fibonacci overlap around 0.6550 (50% expansion) to 0.6570 (61.8% retracement) to open up the 0.6600 (38.2% expansion) to 0.6630 (78.6% expansion) region as the RSI continues to track the upward trend from October.

- However, the RSI may offer a textbook sell-signal as the oscillator falls back from overbought territory, which may trigger a pullback in NZD/USD.

- Will need the RSI to snap the upward trends along with a move below the 0.6490 (50% expansion) to 0.6520 (100% expansion) region to bring the downside targets back on the radar.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.